Circular Financing Solution

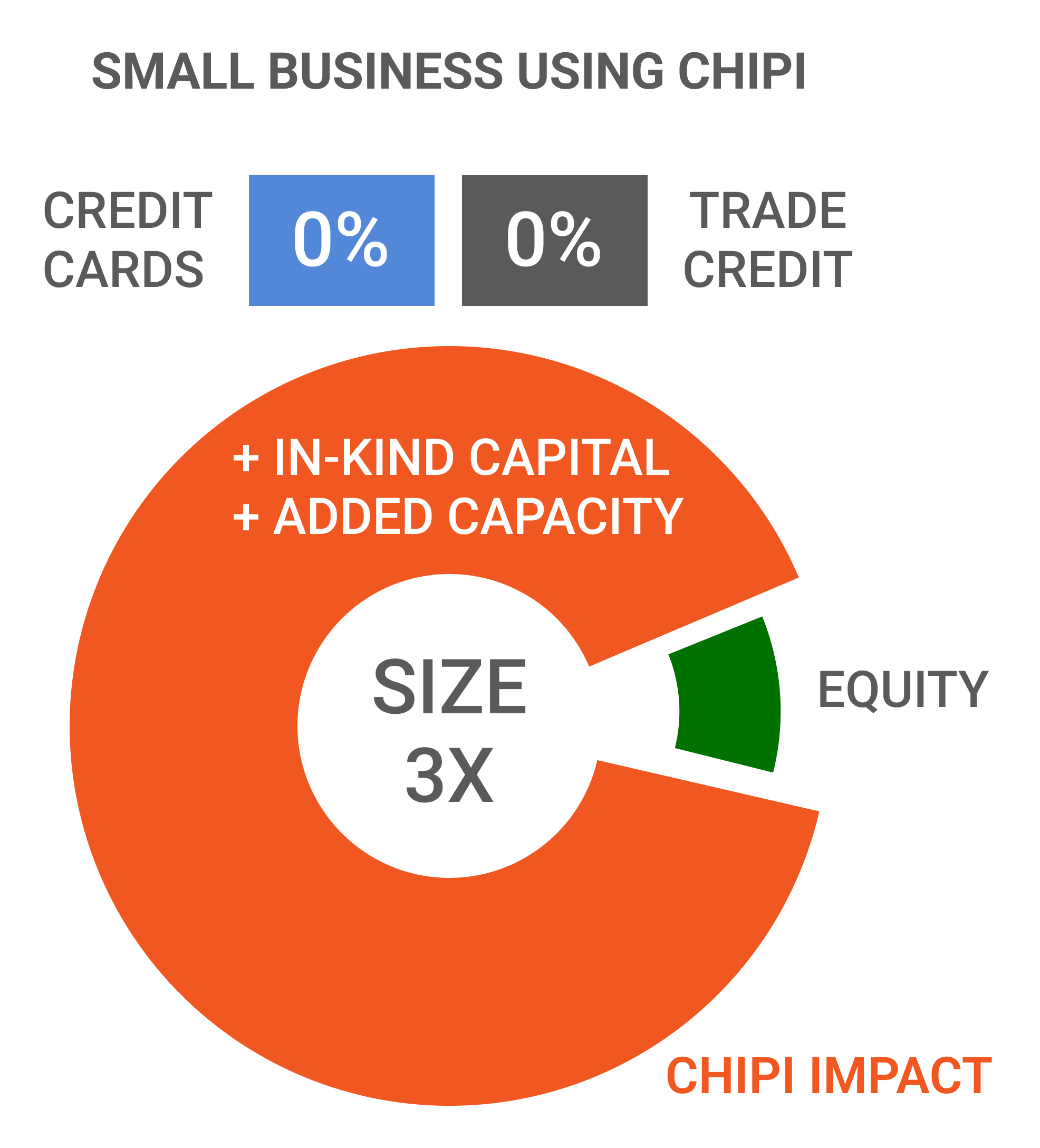

SaaS workflow that enables developers or GC’s to recycle their available liquidity for use by smaller subcontractors

Workforce Growth

Cash Flow Solution

Risk Solution

Attract and grow smaller subcontractors

Eliminate financial barriers that limit capacity

Mitigate performance risks born of financial distress

Cash Flow Solution

Attract and grow smaller subcontractors

Workforce Equity

Eliminate financial barriers that limit capacity

Risk Solution

Mitigate performance risks born of financial distress

Summary of Main Features

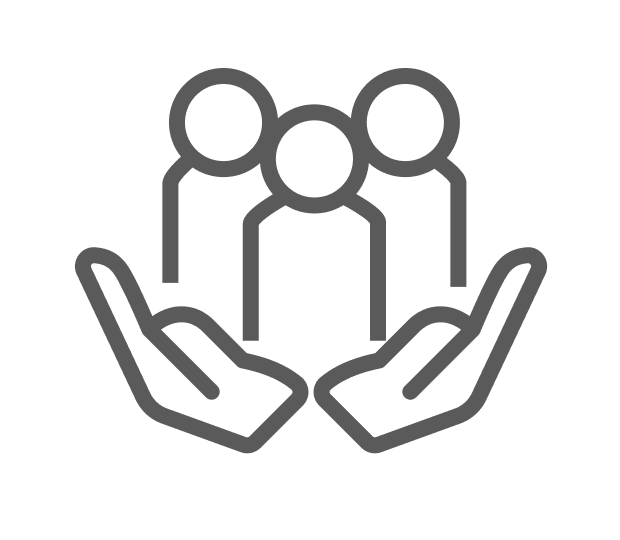

Internal Funding Replaces External Financing

Funding versus Financing?

Funding is usually sourced from an “internal” non-financial entity and may not have a cost or require repayment. Internal entities are part of your value chain.

Financing is always sourced from an external financial entity and includes both cost and repayment.

Internal Funding Replaces External Financing

Funding versus Financing?

Funding is usually sourced from an “internal” non-financial entity and may not have a cost or require repayment. Internal entities are part of your value chain.

Financing is always sourced from an external financial entity and includes both cost and repayment.

Payments reach end-points without intermediary risks or delays

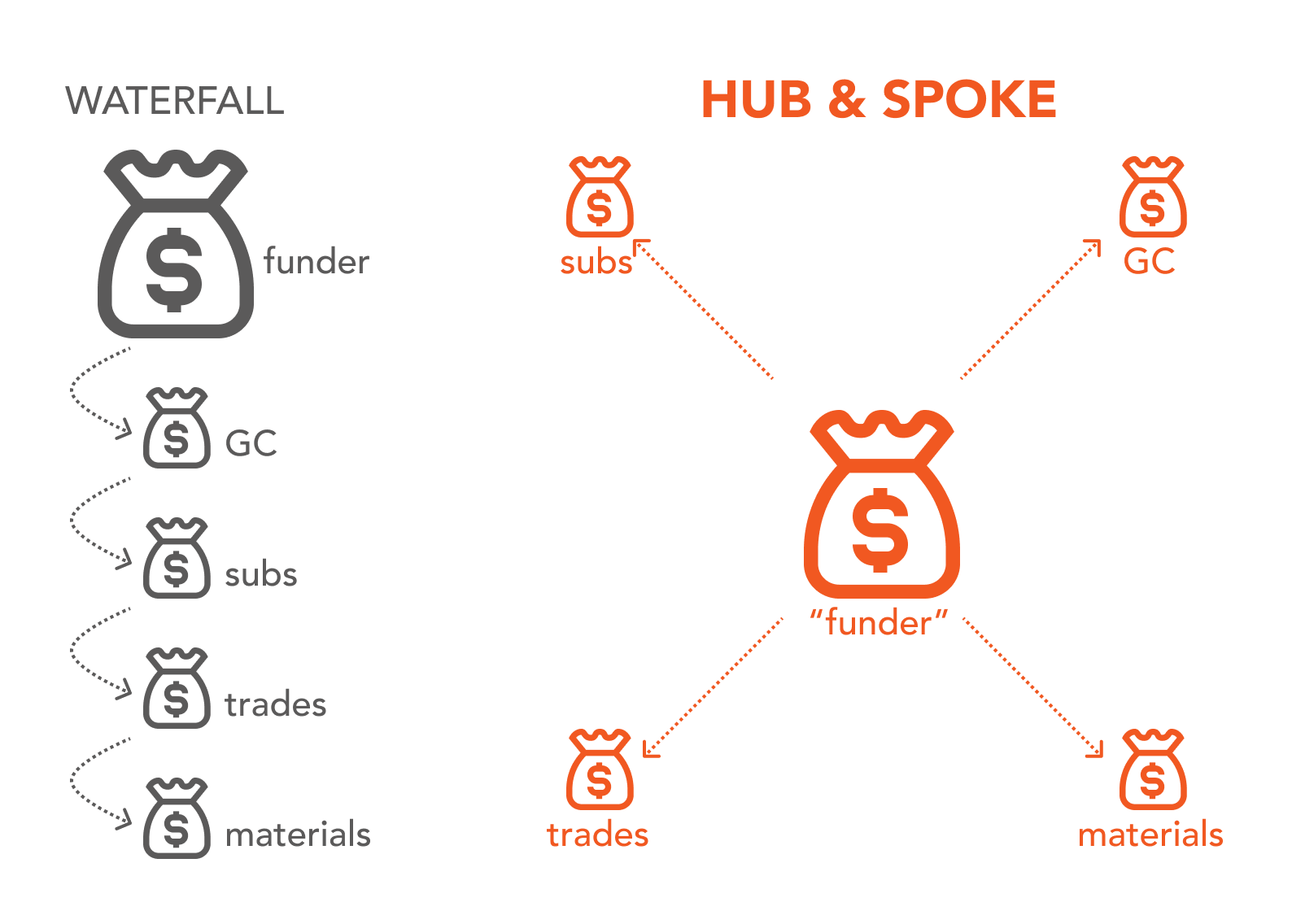

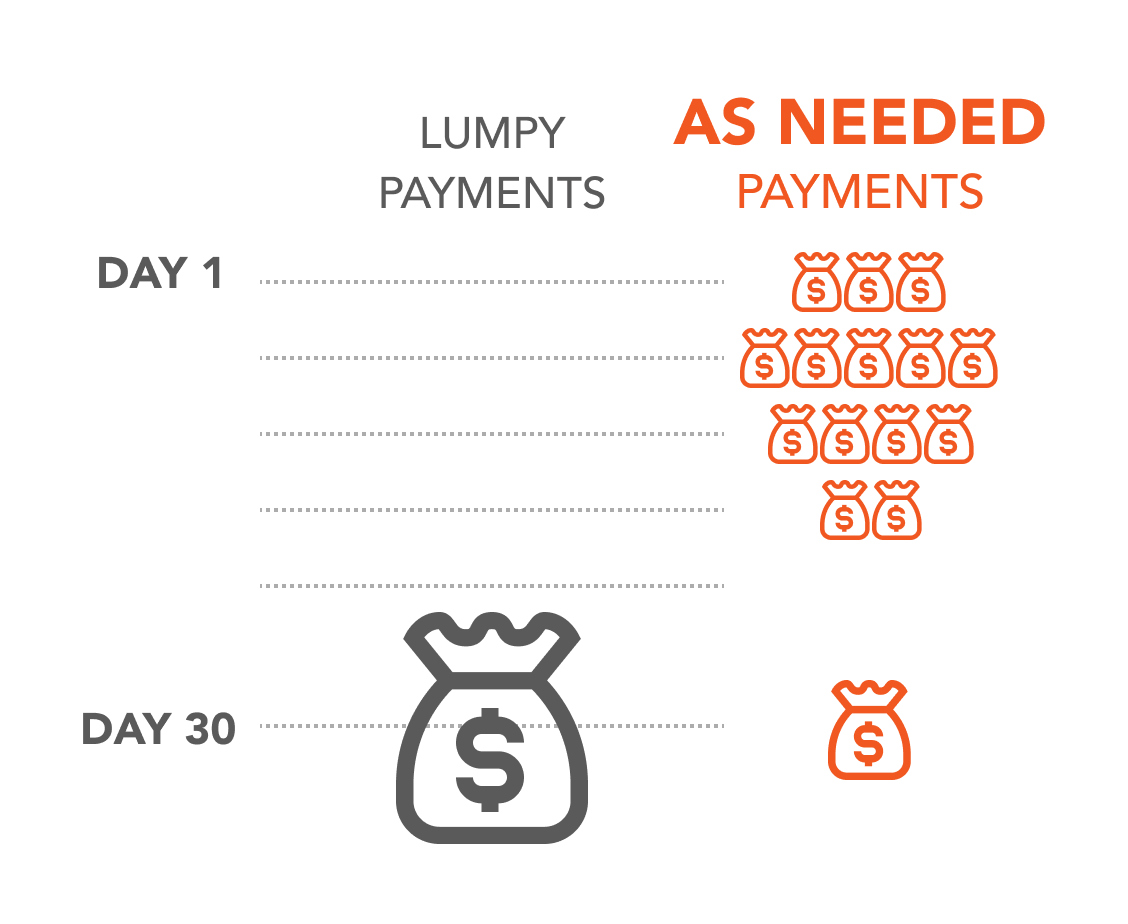

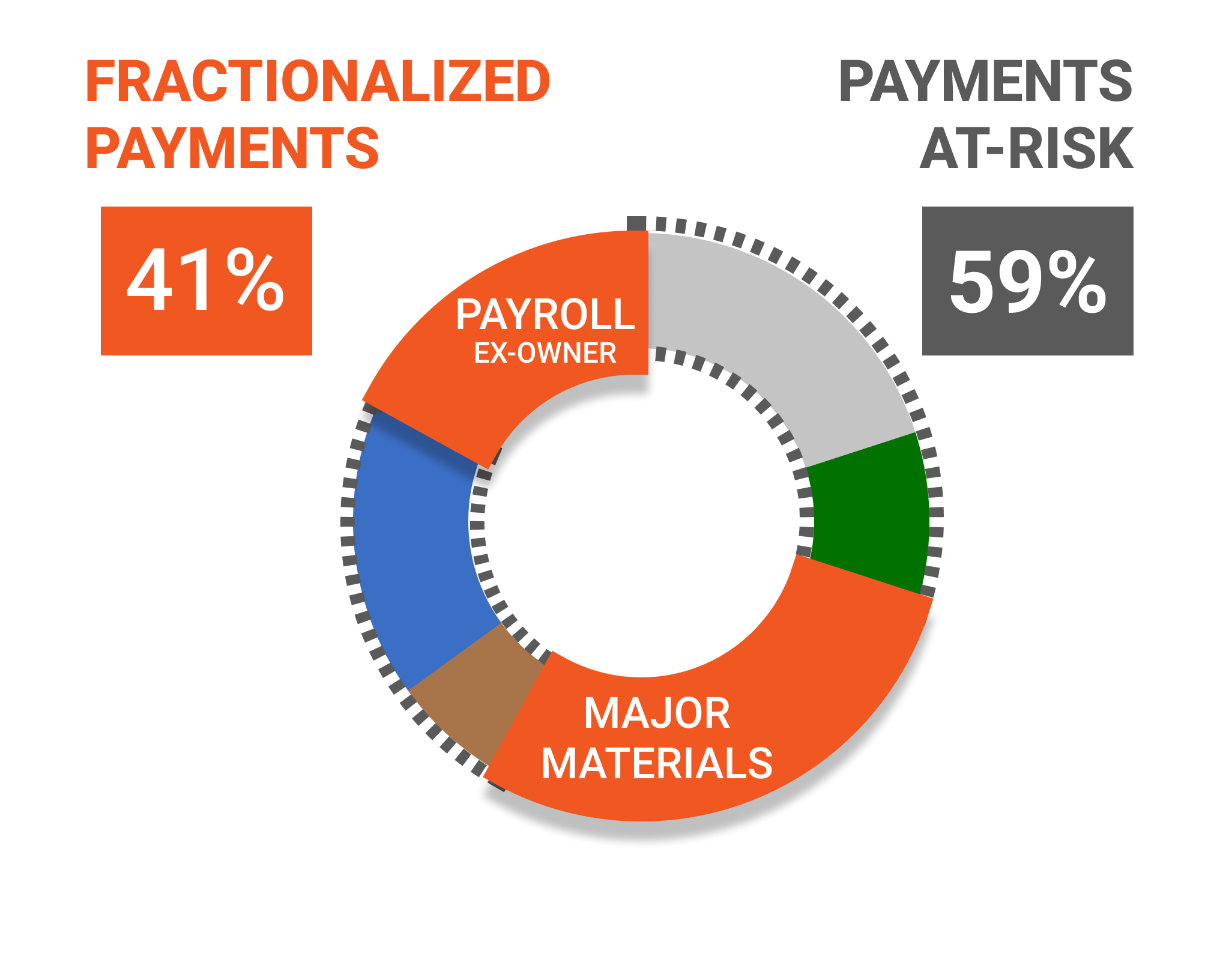

Smaller Programmable Payments Prevents Liquidity Risk

Smaller Programmable Payments Prevents Liquidity Risk

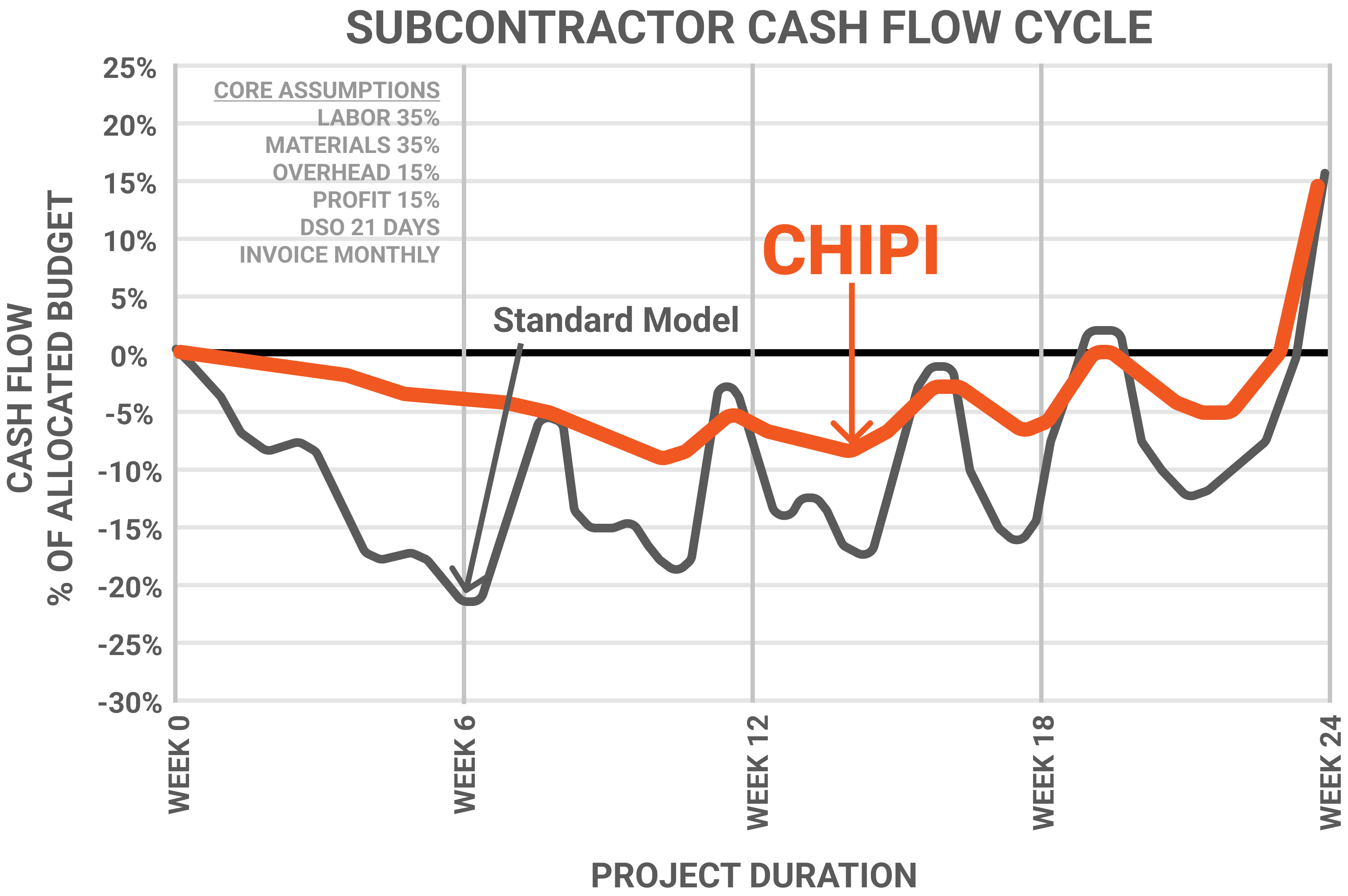

Cash Flow Solution

for small construction businesses

Eliminate the most common and largest challenge for SBE’s – cash flow availability

Risk Solution

for Developers, GC’s, and Tier 1 Subs

Mitigate challenges faced by small subcontractors that introduce risk

Undercapitalization Creates Risks for Projects

80% of all subcontractors spend “a majority of the week” chasing payments.

62%

Create Schedule Delays

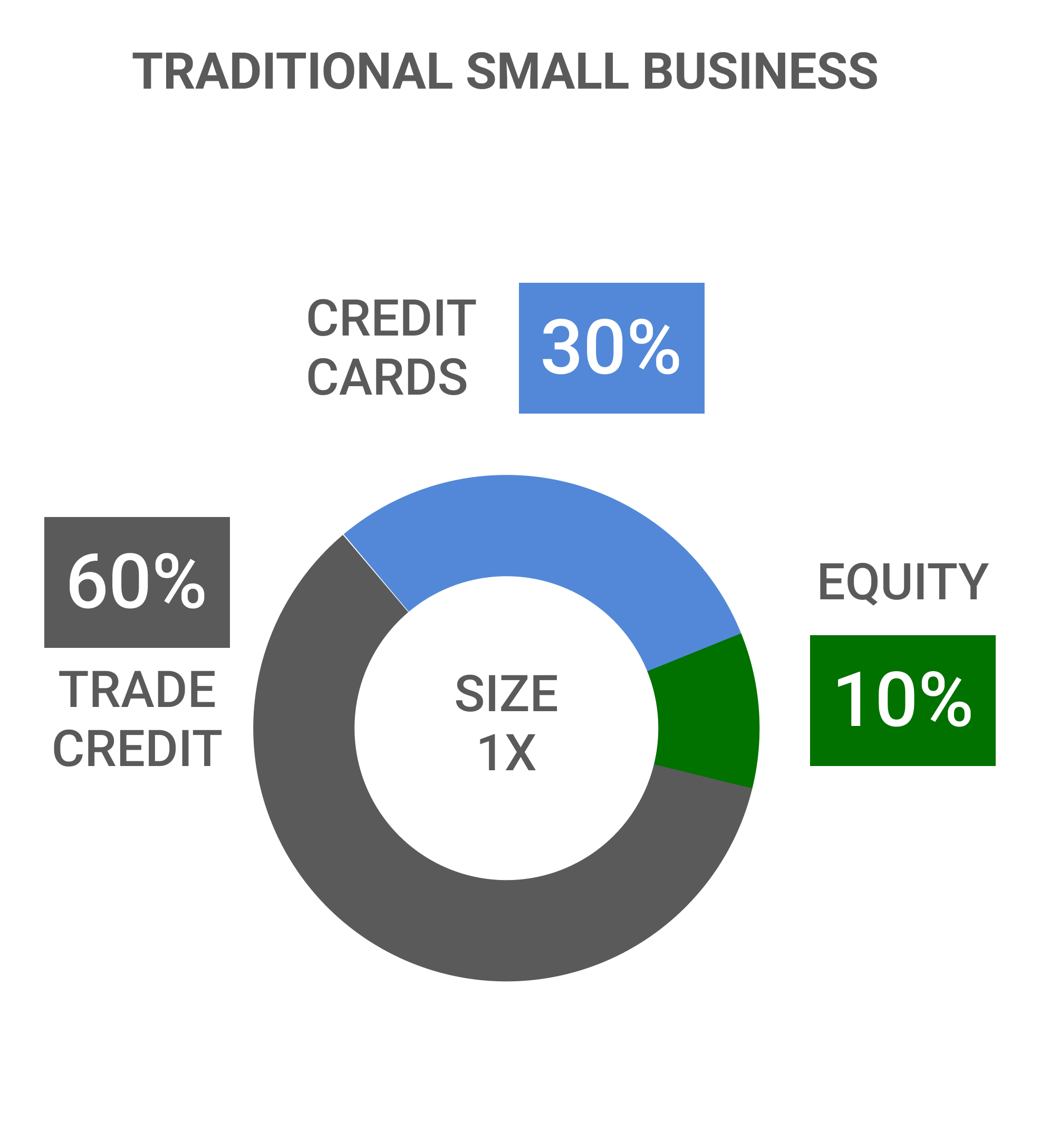

DBE’s and Small Businesses are Underbanked

59% of external financing requires a personal guarantee

9%

Use External Financing

Small Construction Businesses have Low Cash Reserves

Majority-White businesses have 7x the cash buffer of Majority-Hispanic businesses and 13x the cash buffer of Majority-Black businesses.

20

Days Cash Buffer

Construction Failure Rates are High

Exit rates are 59% within 5 years and 73% within 10 years. DBE’s have even higher exit rates, masked by their inability to even enter construction ecosystems.

24%

Failure within 1 year

Days-Sales-Outstanding is High

Materials purchases begin 30 days before the DSO clock starts means suppliers are even more compromised

52

Days Sales Outstanding

Circular Financing Enables SBE Capacity Growth

to attract, grow, and diversify your workforce

Small subcontractors can bypass limited capital and financing access while freely adding production capacity

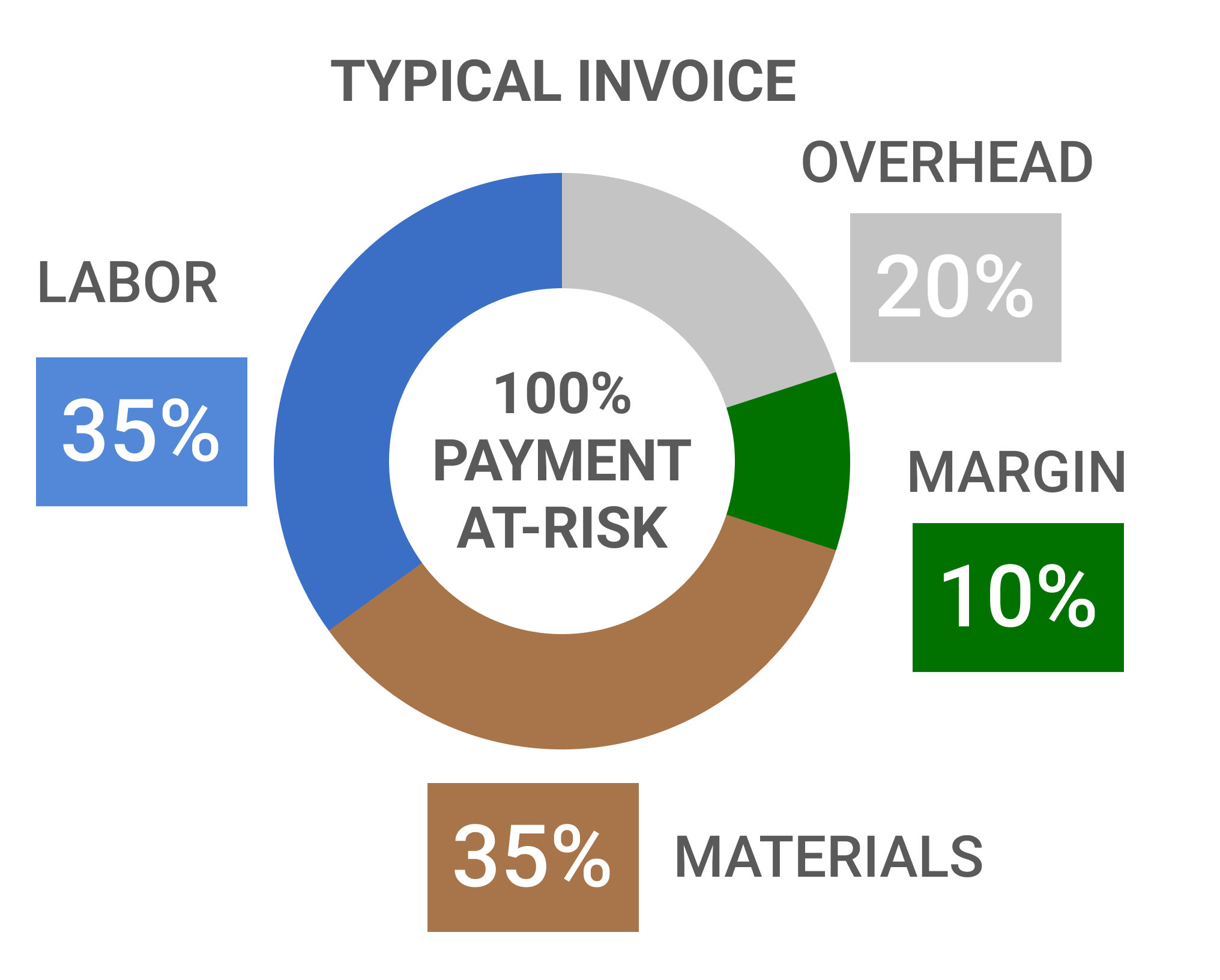

Payment Fractionalization Maintains Financial Alignment

Holding 100% of Payment is an Unnecessary Amount of Leverage and Creates More Serious Risks such as Operating Failures

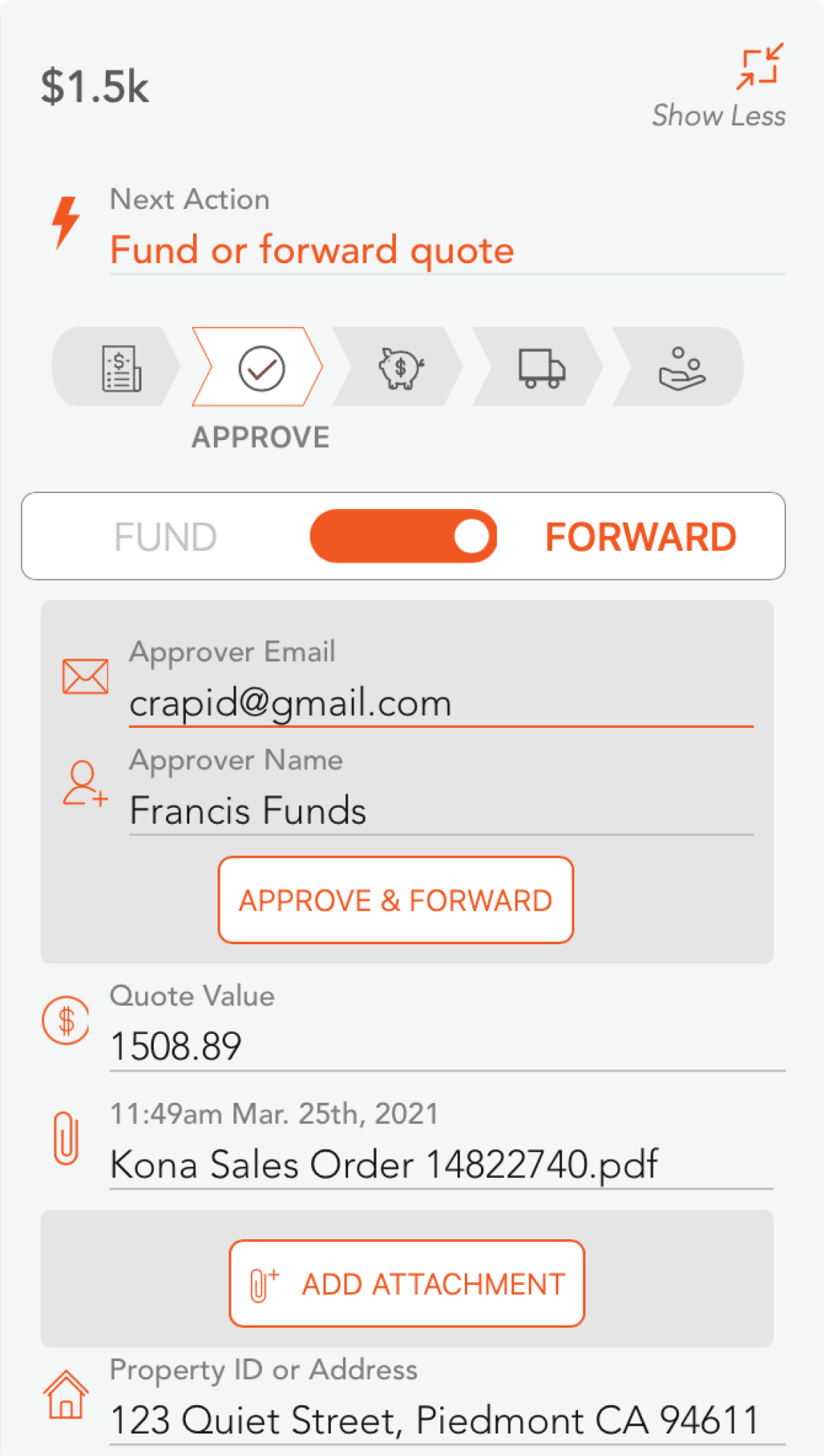

Easy to Use, Handles Every Approval Process

Approval requests can follow any path, at will, and can include as many people as needed.

Chipi can handle simple approval chains or very complex ones.

API Integration

Integrate into your existing technology stack. Request our API’s to integrate into your ERP, payment application, or draw control systems

Alleviating Financing Challenges will Attract Top Subcontractors and Suppliers

Bank your own project and see how it can change productivity and workforce diversity