Social Equity with a Return on Equity

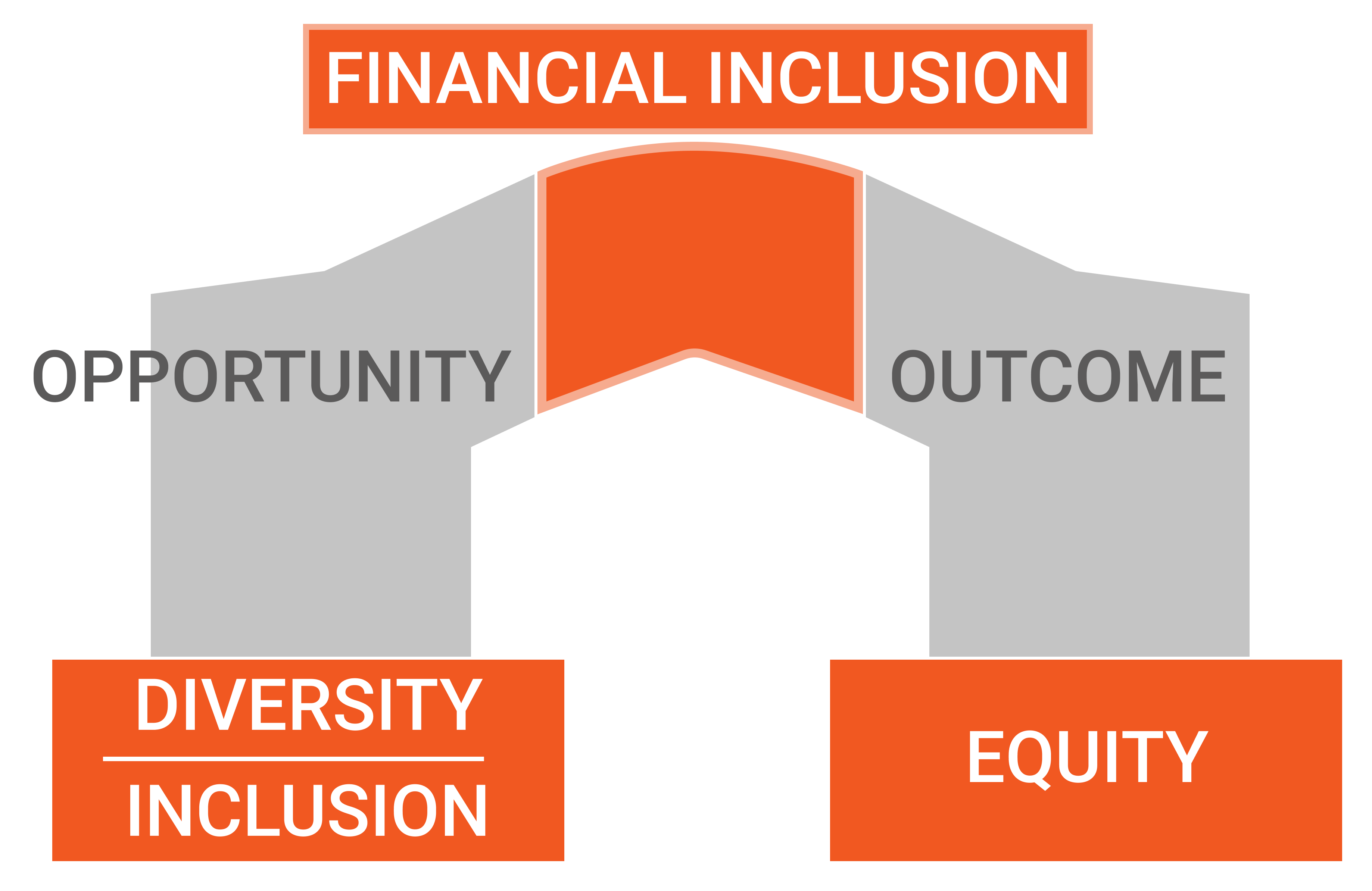

Financial Inclusion is the Bridge between Economic Opportunity and Outcome

– International Monetary Fund

Provide Financial Inclusion so that your D&I Outreach for UBE’s can Blossom

Tangible Social Impact for Anchor Institutions Pursuing Local Hire and Local Procure Goals

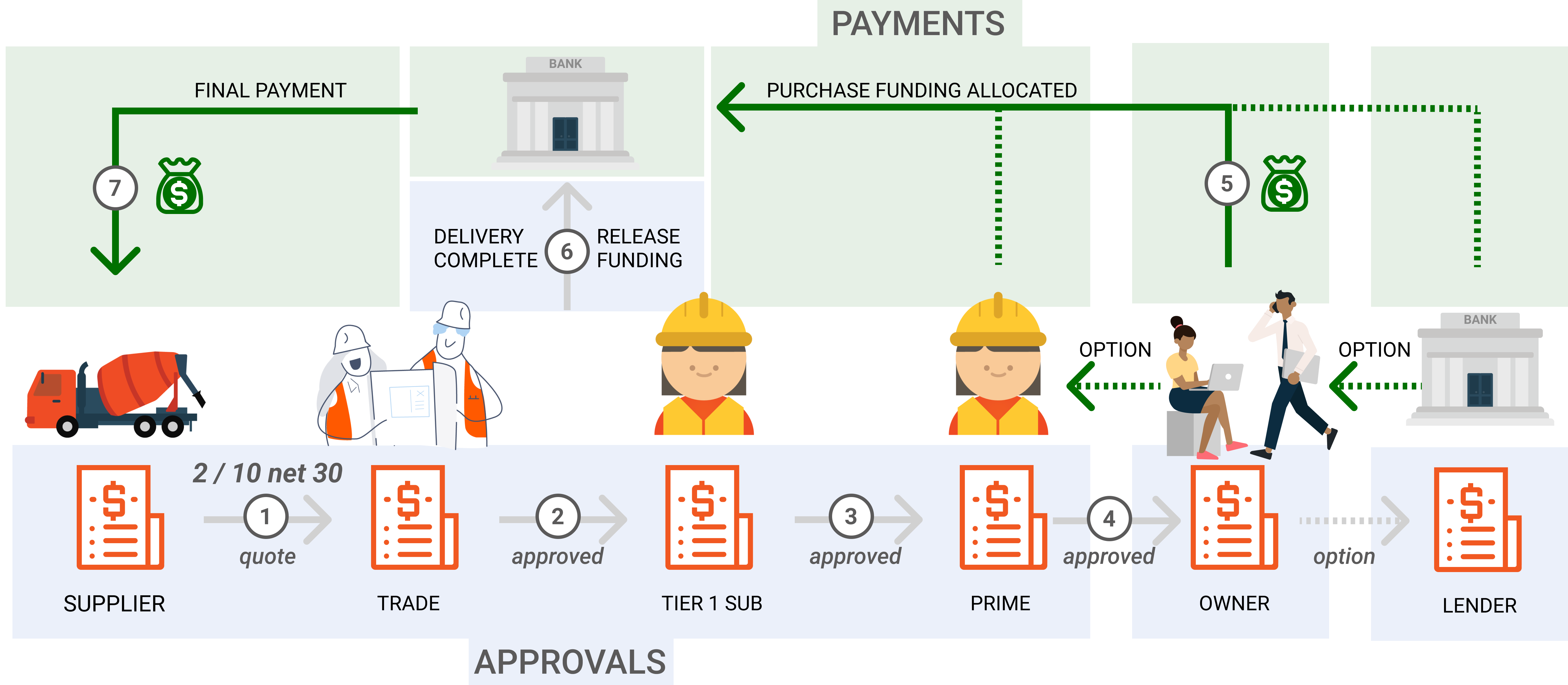

Chipi provides a technology-based workflow that enables large Developers and General Contractors to include small subcontractors and suppliers that are poorly capitalized and underbanked

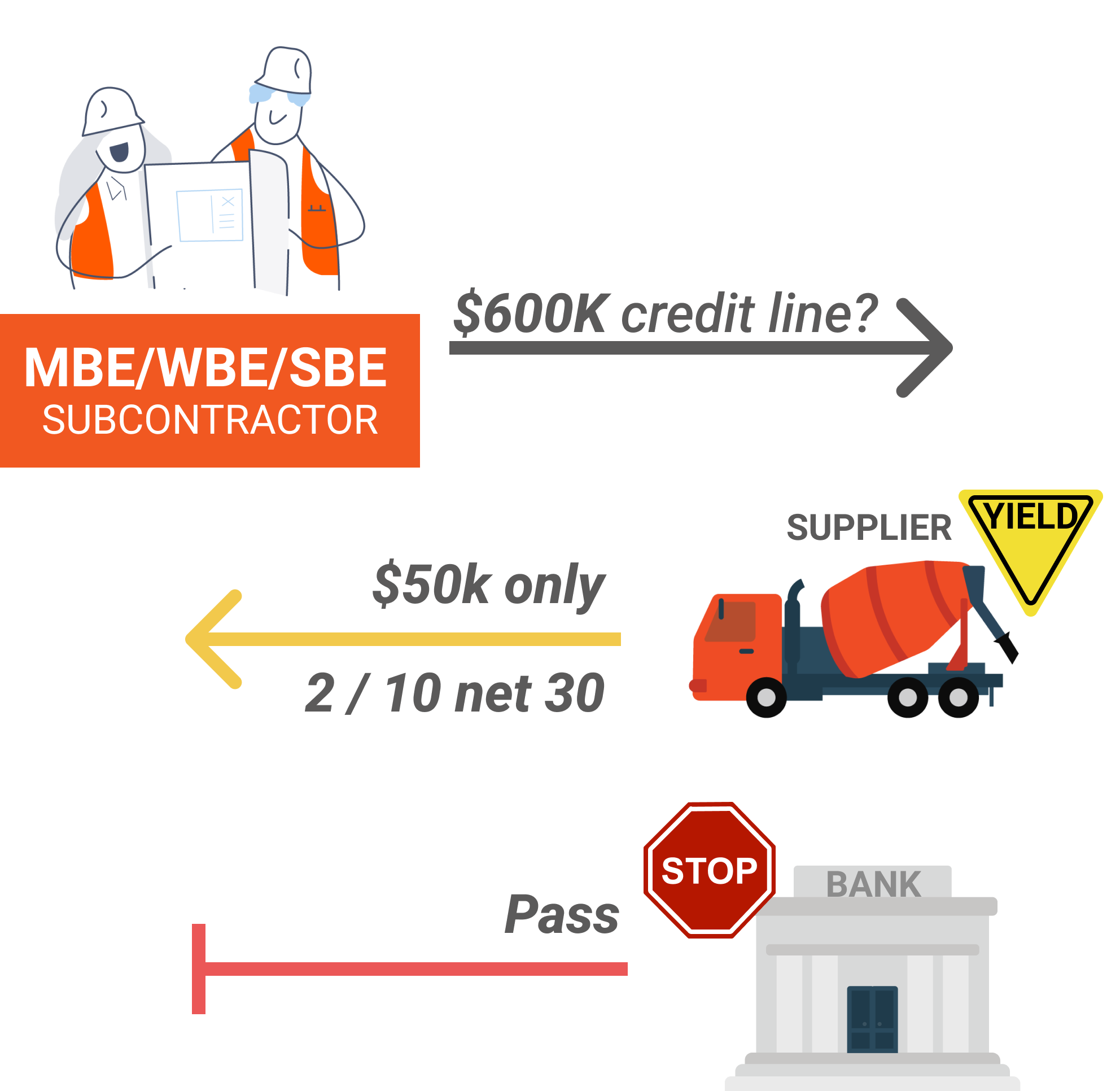

Underserved Small Business Enterprises are Underbanked

Poor financing access leads to cash flow problems and project delays. Diversity and Inclusion are not enough without addressing financing barriers born of systemic disparity that lead to poor outcomes and hence negate your construction DEI solution. Financial inclusion converts opportunity to outcome.

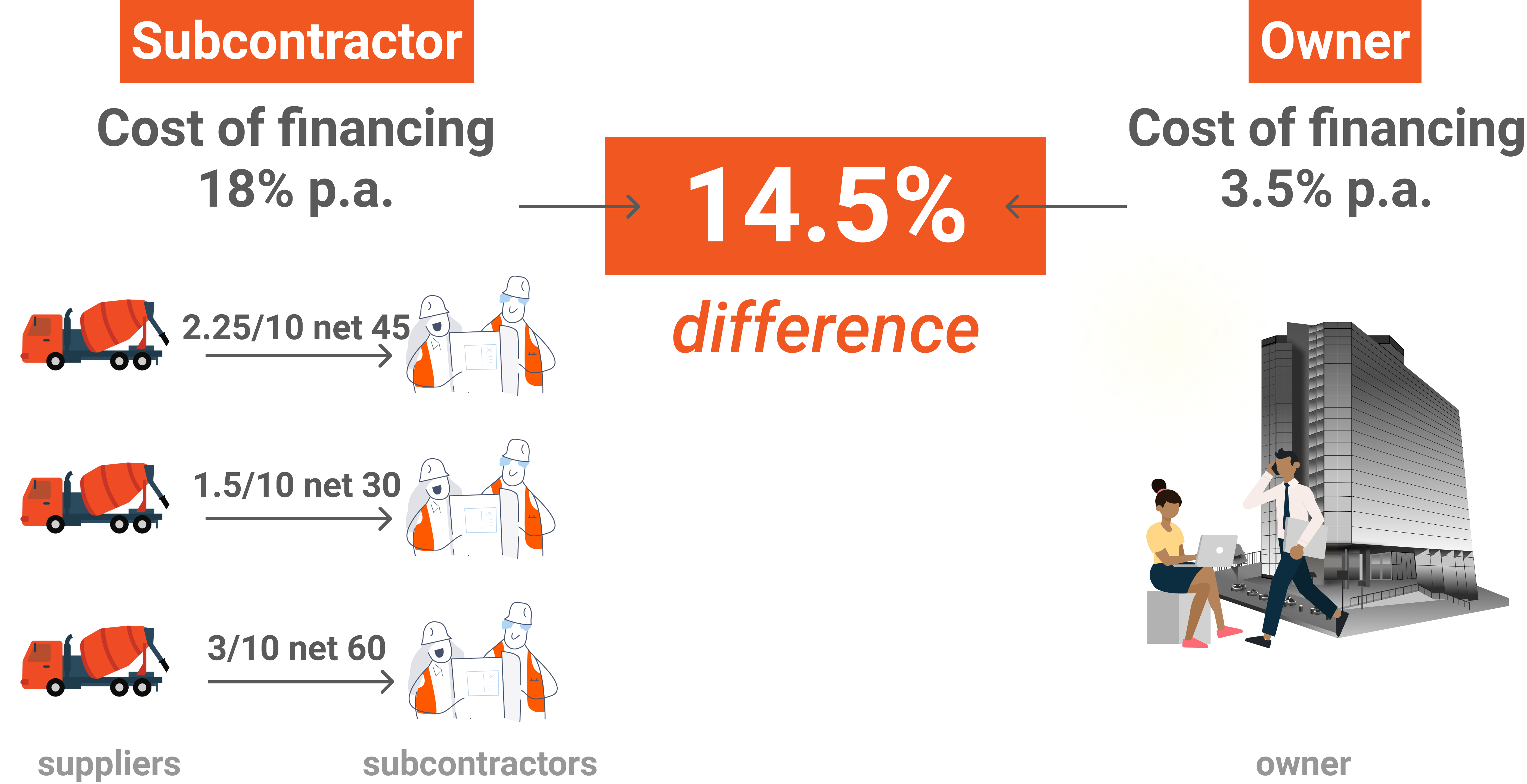

Uncompetitive Bids Reflect Expensive Financing Costs

Cost of financing for small and underrepresented groups is hard to overcome in bidding. Diversity and inclusion are incomplete without intercepting the high cost of capital DBE / UBE / SBE’s are compelled to accept.

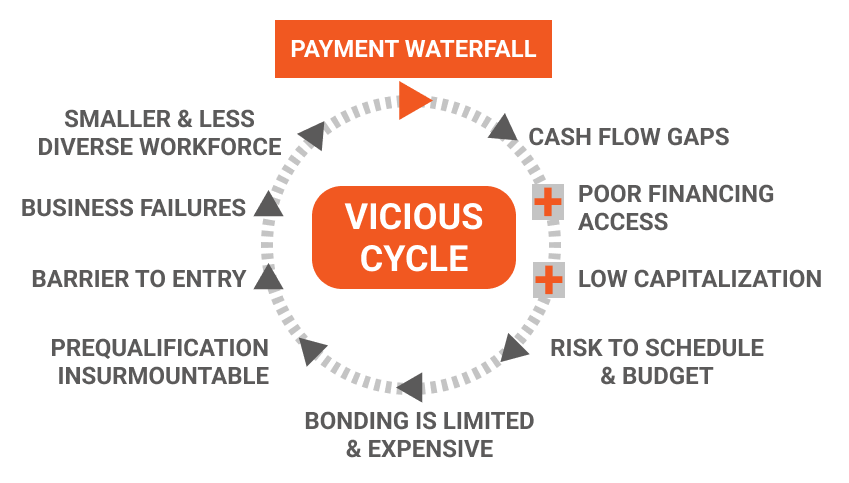

Standard Construction Payment Processes Inhibit Access and Growth of SBEs and UBEs

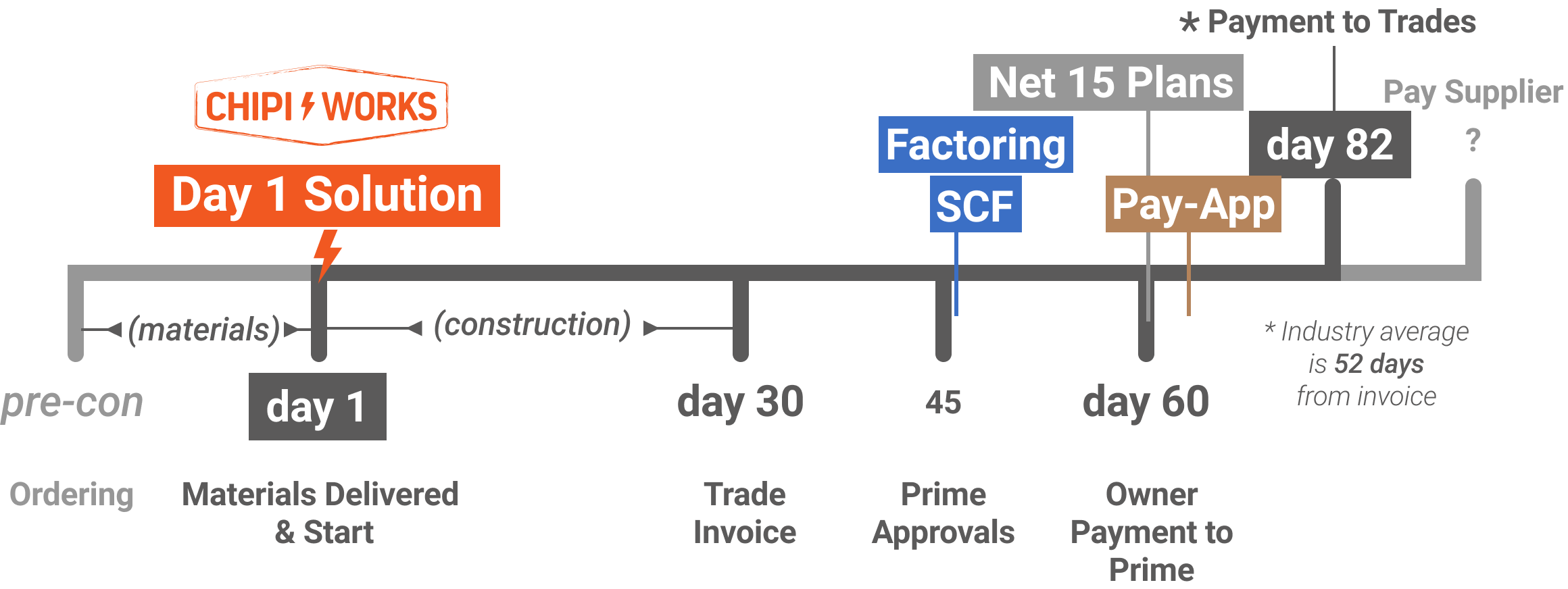

Top-down waterfall payments in combination with low capitalization and poor access to financing make entry into large construction ecosystems difficult and limits any available capacity

Developers Insert Their Financing to Solve for Financial Inclusion

Eliminate financing barriers and financing duplication costs for DBE and SBE’s. Chipi enables developers to substitute their capital to finance construction materials purchasing, risk-free. Achieve a double win as you dramatically increase the success of your construction DEI solution while lowering project costs and risks.

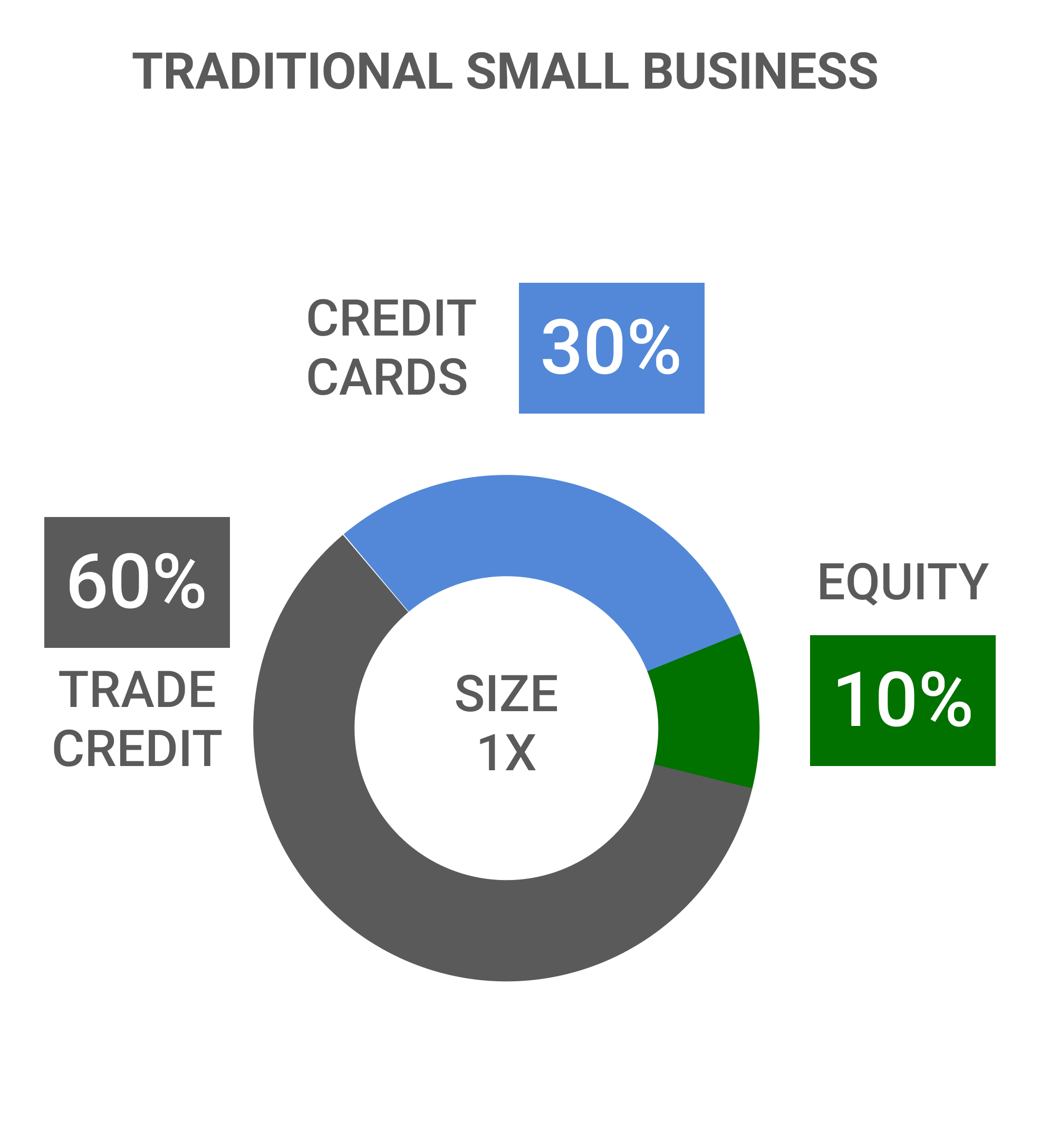

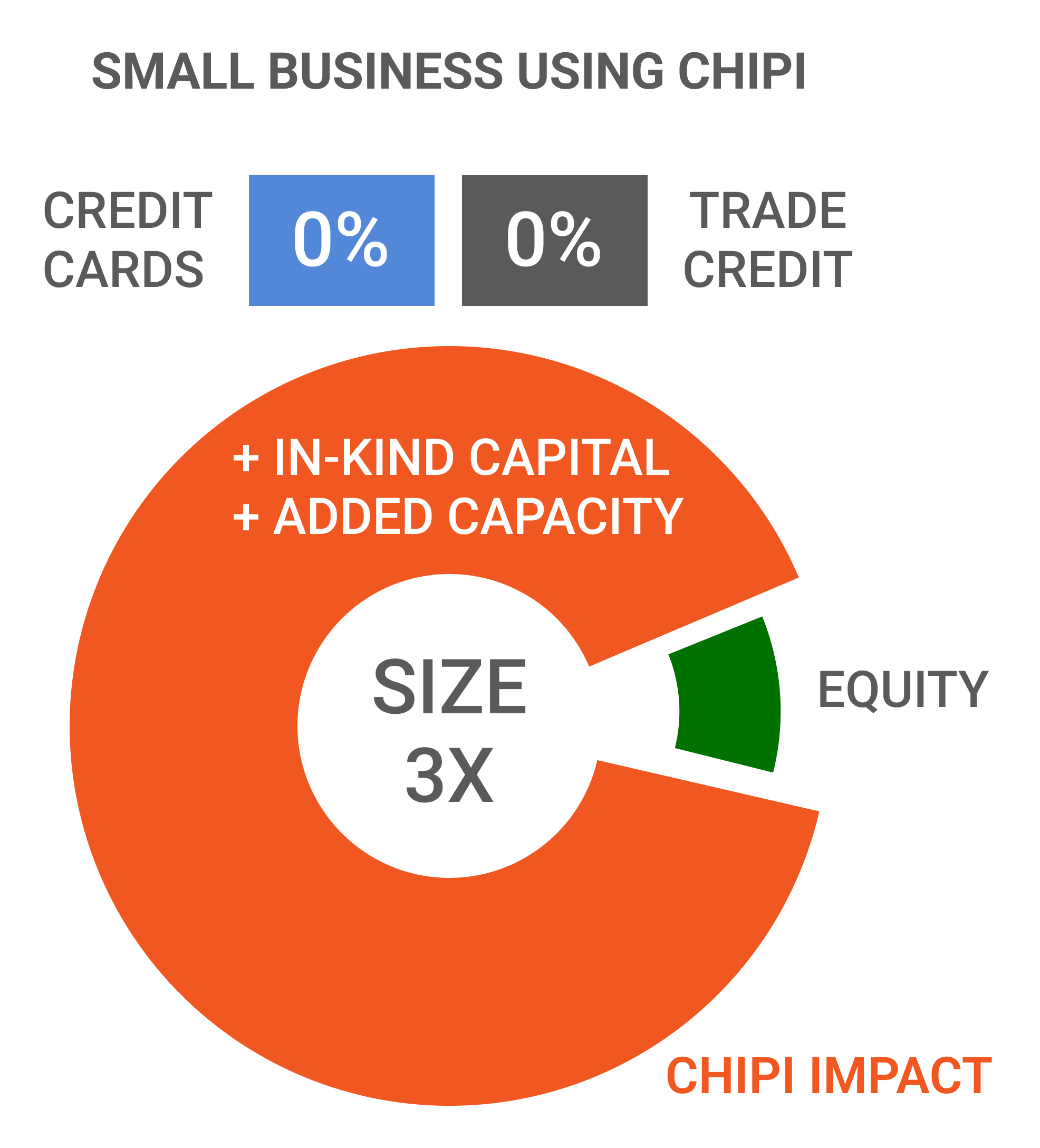

External Finance Replaced Efficiently and Capacity Expansion Enabled

Creating Access to the Asset Developers Funding Scale Replaces the Initial and Ongoing Capital and Financing Needs of Subcontractors and Suppliers

Financing Barriers become Irrelevant

Increase Inclusion and Equity. Project risks born of contractors’ liquidity challenges are addressed at day 1. Inclusion is increased by eliminating barriers to entry. Equity is increased by removing unequal access to financing.

Full Transparency of Spend and Beneficiaries

Visibility of all subcontractors and suppliers involved in materials purchasing. The workflow makes it clear which subcontractor (and person) is requesting funding, which materials supplier will be paid upon delivery, and the materials being purchased.

Transparency is central to the process and available to everyone involved in approvals.

Get efficacy metrics in real-time.

CEO Introduction to Benefits for Project Developers and Funders

Reveal the Hidden Workforce

Discover Hidden SBE’s. Labor supply will reveal itself once financial barriers are removed.

Banking services are very limited for even the most experienced businesses.

Making it easy for people to enter the industry. A market solution that will generate a market response.

Eliminate Financial Risk

De-risk your value chain. 1 in 4 businesses fails within 1 year. Weak Cash-flow is the #1 reason.

Chipi removes the main use of cash flow for subcontractors and small suppliers. Doing so eliminates the risk of including them on your project team.

Exceed Anchor Institution and Community Workforce Goals

Economically and Socially Responsible goals met. Offer an effective and easily understood solution that will demonstrate commitment to communities, municipalities, and unions.

Fulfill local hire goals (SBE, Micro), BIPOC goals, Targeted Disadvantaged Worker goals, Minority Business Enterpreise and Woman Business Enterpreise goals, and VOBE, DBE, LGBTQ, xBE, and UBE goals.

Exceed Anchor Institution and Community Workforce Goals

Economically and Socially Responsible goals met. Offer an effective and easily understood solution that will demonstrate commitment to communities, municipalities, and unions.

Fulfill local hire goals (SBE, Micro), BIPOC goals, Targeted Disadvantaged Worker goals, Minority Business Enterpreise and Woman Business Enterpreise goals, and VOBE, DBE, LGBTQ, xBE, and UBE goals.

Financial Inclusion is a Prominent Enabler the UN’s SDG’s

Financial inclusion is critical to a better future. Sustainable Development Goals (SDGs) are an urgent call to pursue strategies that improve health and education, reduce inequality, and spur economic growth while tackling climate change. Addressing the underbanked is a core requirement.

Increase Capital Absorption for Targeted Communities

Place money directly into communities. Channeling money into local builders and suppliers is the best means of getting additional impact on your construction spend.

Chipi gives you a direct financial link to the small businesses that are benefiting from your project.

Further, we give you the data you need to measure efficacy and compliance.

Increase Capital Absorption for Targeted Communities

Place money directly into communities. Channeling money into local builders and suppliers is the best means of getting additional impact on your construction spend.

Chipi gives you a direct financial link to the small businesses that are benefiting from your project.

Further, we give you the data you need to measure efficacy and compliance.

Frequently asked questions for Diversity, Equity, and Inclusion

How is Chipi Anti-Racist and Anti-Oppressive?

Chipi removes financial barriers that reflect not only antiquated methods of dealing with mistrust and control, but that also reflect systemic biases built up over decades that lock-out certain groups.

How does Chipi remove financial barriers?

Chipi gives the project owner or funder the mechanism to pay for the bulk of the needed materials. This alleviates the requirement for the front-line builders or suppliers to do so and hence removes the main financial requirement that triggers a need for capital and banking. A smarter payment workflow delivers better construction outcomes while enabling financial inclusion.

Will Chipi data flow into our current invoicing or ERP system?

Yes! If you’d like data interoperability with Chipi, you can request that we integrate with your system (if not already done so) or you can access Chipi API’s to integrate with us.

How does Chipi improve capital absorption?

Chipi enables you to use the same dollars used for your construction project to also be placed directly into communities by making direct payments to the local suppliers on behalf of local builders. Eliminating the financial hurdle of materials procurement is the equivalent of placing capital directly into these small construction businesses. In doing so, you are achieving deep and direct penetration into supporting a community without adding costs or risks.

Also, because you are making payments directly to suppliers, you have a catalog of each SBE/UBE you are directly benefitting and the amount of that benefit.

What are the benefits to the owner/developer besides realizing DEI goals?

Less risk and a new income source!

1) Chipi will enable the owner to capture financing arbitrage.

2) Financially weak sub-contractors have been shown to create project delays.

3) Subs/Trades will often mistime deliveries and hence miss schedules because they try to manage a just-in-time materials ordering process as a cash-flow management technique. JIT requires planning tools and sophistication that is typically beyond their capabilities so failures should be expected. Chipi removes this just-in-time cash-flow pressure so that materials can be ordered with proper lead times that account for the realities of logistics.

4) Collaboration is often disrupted as slow progress payments lead to mistrust and finger-pointing rather than working through issues. Collaboration requires trust but financial distress turns into a virus of mistrust that infects all parties. Removing financial distress allows collaboration to blossom.

5) Eliminates operational risks. Including small businesses on your team does introduce the risk of operating continuity. Construction margins are so thin that small mistakes can put people and firms out of business. 1 in 4 construction businesses will fail within 1 year. Chipi minimizes or eliminates this risk.

What are the benefits to the Prime GC?

Faster and better project delivery! Since you are removing a major financial obligation for your subs and trades, they are in a better position to work efficiently and to collaborate without the overhang of payment discussions.

Use your purchasing power! You can negotiate better materials prices than a small front-line trade. Because Chipi is representing your resource depth in the payment process, you can achieve better pricing and service.

Attract the best talent! Eliminating financial costs and problems will enable you to attract the best talent since your project is relatively more attractive than others.

Develop a new workforce! Eliminating financial barriers is a market based solution that will elicit a market response. Once people realize a new opportunity exists that doesn’t require start-up capital and ongoing cash-flow, they will reveal themselves to you enabling you to broaden and deepen your talent base.

Less risk! The financial vulnerability of small subs and trades is no longer a performance risk for you. Pre-lien / Preliminary Notice workflows and mechanics liens risks from suppliers are eliminated.

Build community wealth and capacity! The elimination of the capital requirements needed to properly support your project enables you to hire local people from all backgrounds. This not only increases wealth retention in a community but builds a renewable resource of skills and experience to deepen your impact.

What are the costs?

See our pricing page.

There are no costs for any part of the value chain except for materials suppliers (note: individual property owners will see a $15 transaction fee).

How it works: when Chipi makes the final payment to a supplier on behalf of the funder, we withhold an early-pay discount which is widespread in the industry. For institutional projects, the exact discount is determined by the project owner or Prime GC in advance so you will know your cost before participating. The cost will certainly be lower than the cost of providing trade credit and will enable you to make larger sales to your customers (since there is no credit extension or credit risk). For small projects, Chipi will withhold your current or standard early-pay discount, subject to a minimum that will be available for review prior to engaging in a Chipi process.

What are the risks?

There are no additional risks for anyone. Indeed the Chipi process reduces risks for all parties.

The owner does have an edge case risk in the circumstance where a subcontractor has been fired for poor installation. In an extreme case, materials may need to be repurchased (since the owner has paid for materials prior to installation). The economic value of this risk is a small fraction of the financing arbitrage value alone. Further, the value of this edge case risk is also a fraction of the risks and costs mitigated by the Chipi process:

- eliminating value chain cash flow problems that lead to delays in progress

- eliminating pre-lien document workflows and mechanics liens from suppliers

- intercept and eliminating progress delays due to untimely materials delivery that starts with subcontractors holding orders until the last moment to manage cash flow or credit limits

- intercept and eliminate untimely materials delivery. The cycle starts with sub weak cash flow –>delaying materials order –>missed delivery schedule –> missed project schedule

- collaboration breakdowns born of friction around payment timing

- economic and social impact of unequal access to financing and construction ecosystems