CRA Impact with Developer Credit Risk

Provide increased access and opportunity to underserved and disadvantaged construction businesses at the credit risk of the project developer.

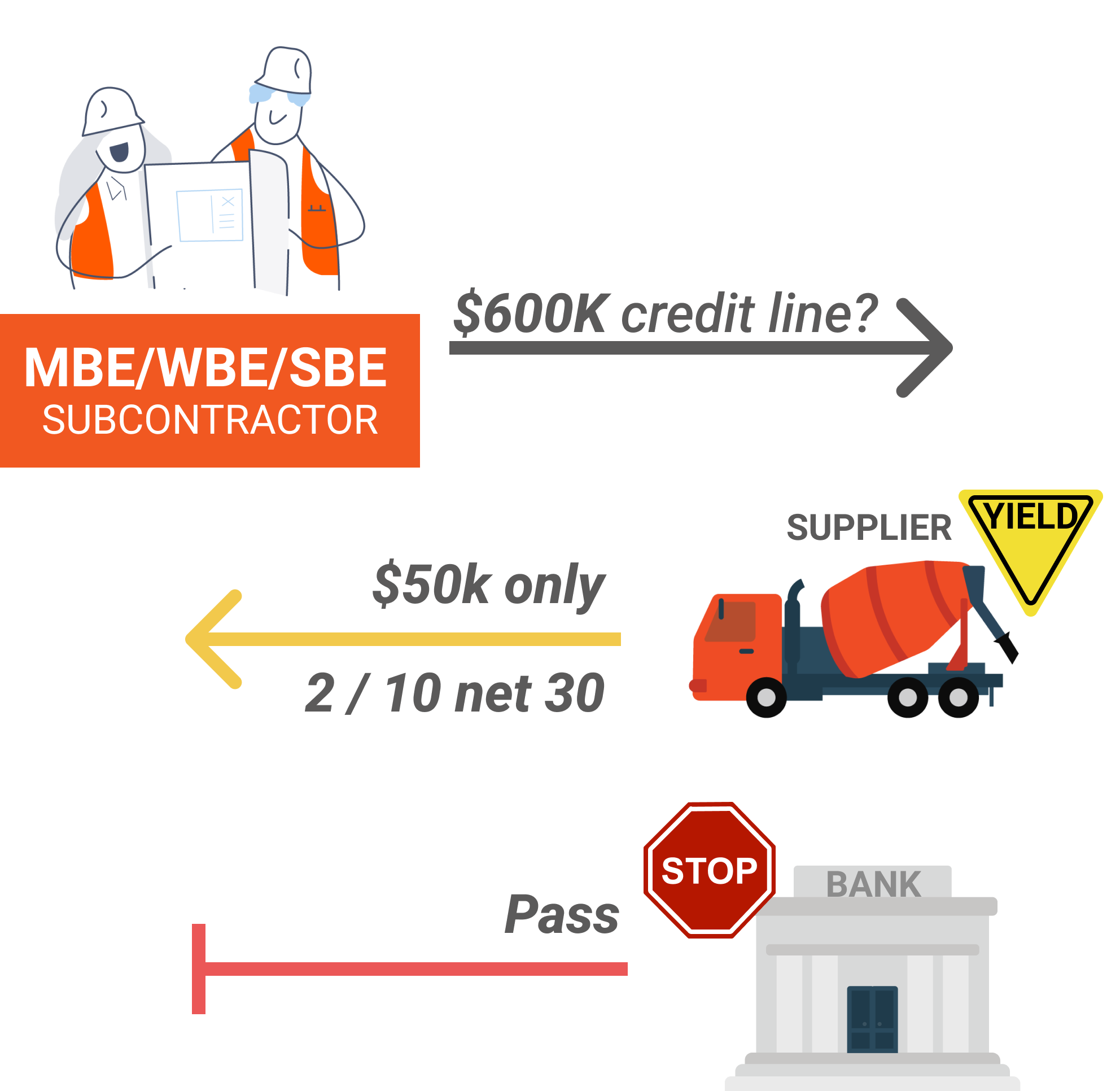

Direct Lending to Small Subcontractors has Challenges

Direct Lending to Small Subcontractors has Challenges

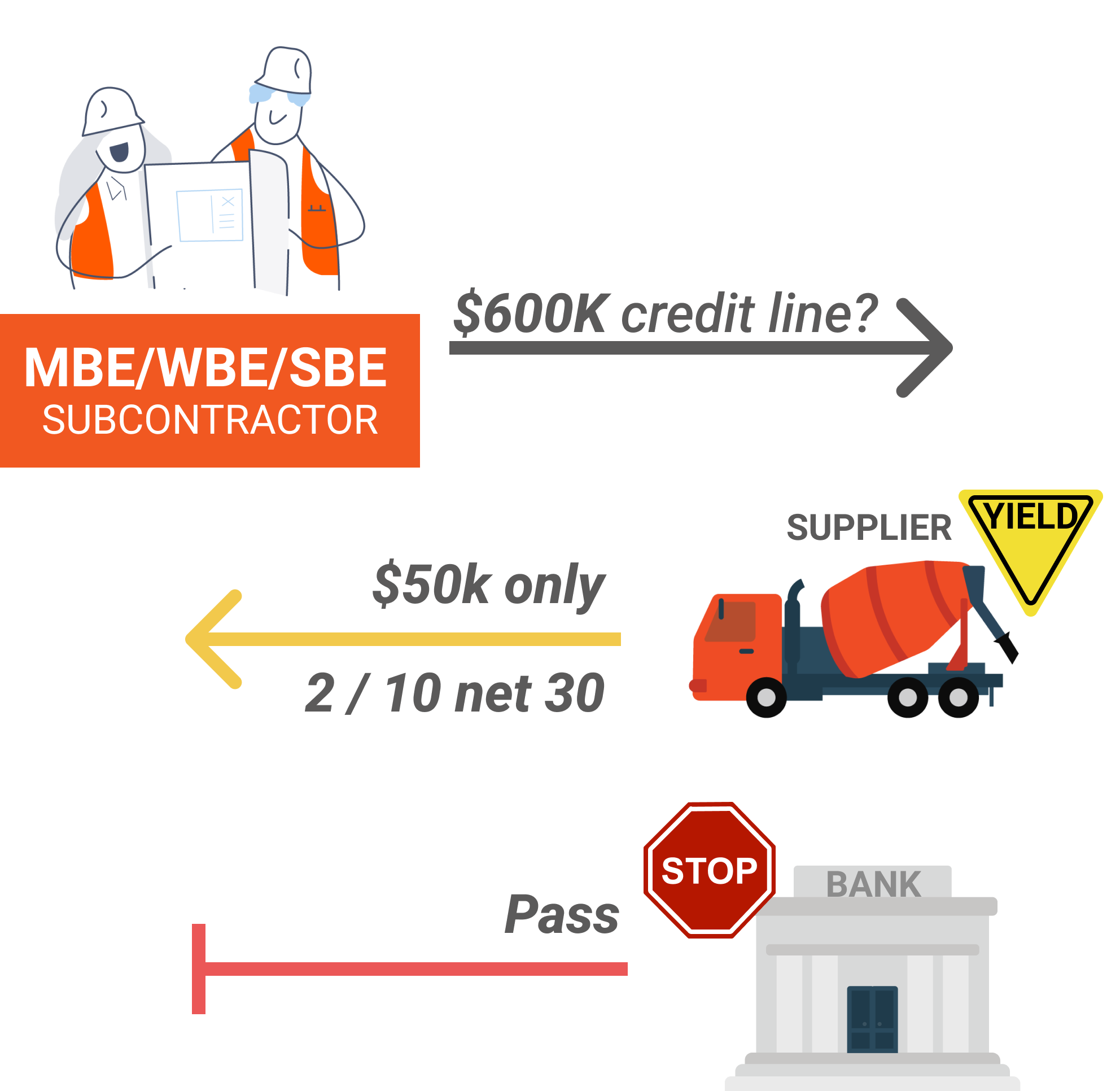

Small and DBE Subcontractors are Compelled to Source Expensive Financing

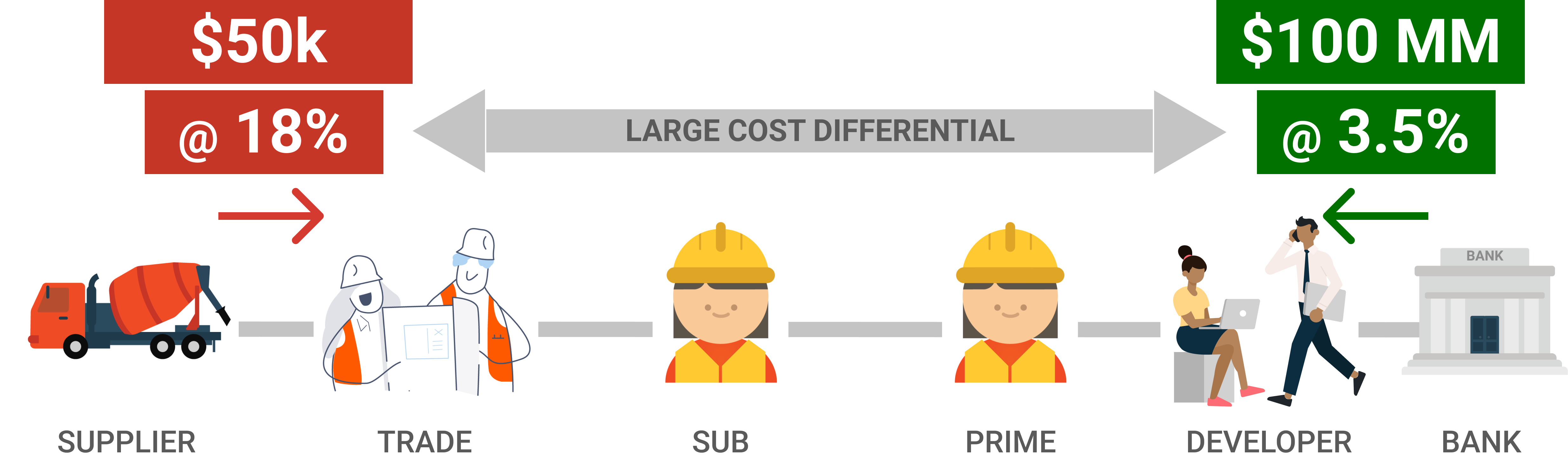

Provision Your Capital to Fill DBE Financing Needs at the Credit Risk of the Developer

Remove capital barriers and costs for DBE’s

Capture additional interest margin for capital provision

Small Construction Businesses are Poorly Capitalized

Majority-White businesses have 7x the cash buffer of Majority-Hispanic businesses and 13x the cash buffer of Majority-Black businesses.

20

Days Cash Buffer

62%

of Poorly Capitalized Subs Introduce Schedule Delays

Eliminate Schedule Delays caused by Cash Flow Stress

Disadvantaged businesses have low levels of capital and poor access to financing.

Eliminate Schedule Delays caused by Cash Flow Stress

Disadvantaged businesses have low levels of capital and poor access to financing.

62%

of Poorly Capitalized Subs Introduce Schedule Delays

Failure Rates for Small Construction Businesses are High

Exit rates are 59% within 5 years and 73% within 10 years. DBE’s have even higher exit rates, masked by their inability to even enter construction ecosystems.

24%

Failure within 1 year

9%

Use External Financing

DBE’s and Small Businesses are Underbanked

Accessing financing is difficult. 59% of external financing requires a personal guarantee that can make business challenges devastating to livelihoods.

DBE’s and Small Businesses are Underbanked

Accessing financing is difficult. 59% of external financing requires a personal guarantee that can make business challenges devastating to livelihoods.

9%

Use External Financing

Subcontractors and Suppliers are Financing Developers

The average DSO for subcontractors is 52 days but materials supplier purchases are completed 30 days ahead of invoicing leaving negative cash flow that approaches three months.

82

Days Sales Outstanding

Eliminate the Incentive to Order Materials at the Last Minute

Small and DBE subcontractors utilize various techniques to minimize cash flow problems. Ordering materials at the last minute results in missed delivery schedules which pushes out project timelines.

Eliminate the Incentive to Order Materials at the Last Minute

Small and DBE subcontractors utilize various techniques to minimize cash flow problems. Ordering materials at the last minute results in missed delivery schedules which pushes out project timelines.

Eliminate Mechanics Lien Workflows and Risks from Suppliers

Paying for materials upon delivery eliminates pre-lien workflows and mechanics liens risks coming from suppliers.

Deploy a Scalable Solution to DBE Lending that Reduces Risk and Increases Margins