Construction Payments as a Competitive Advantage

Tap into your advantages in capital and financing to solve common cash flow problems for your ecosystem. You’ll attract a scarce supply of talent, provide access to underrepresented groups, and reduce production risks.

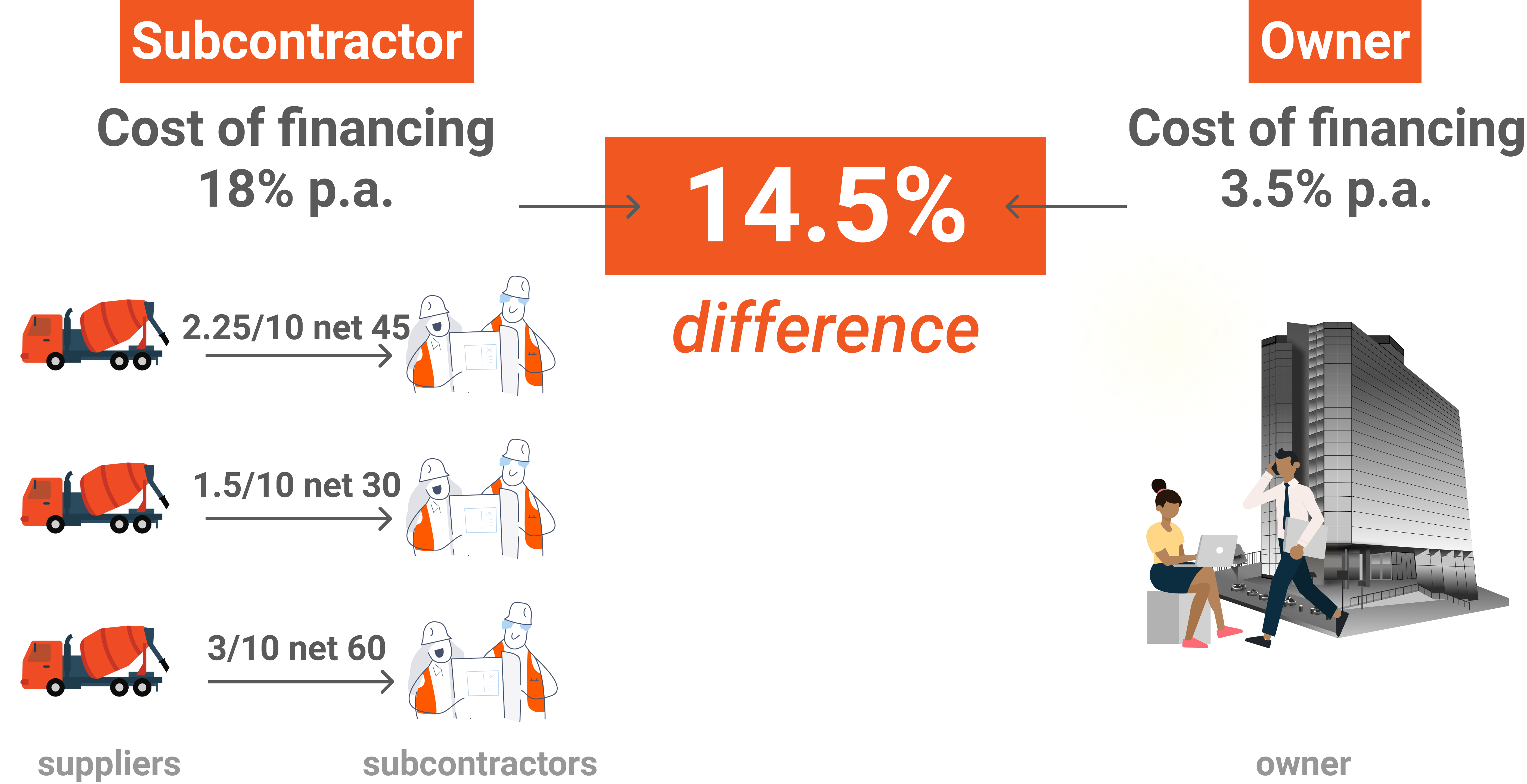

Inflated Subcontractor Bids Reflect High Cost Credit

Materials prices reflect expensive financing. Subcontractors of all sizes depend heavily upon suppliers for financing purchases.

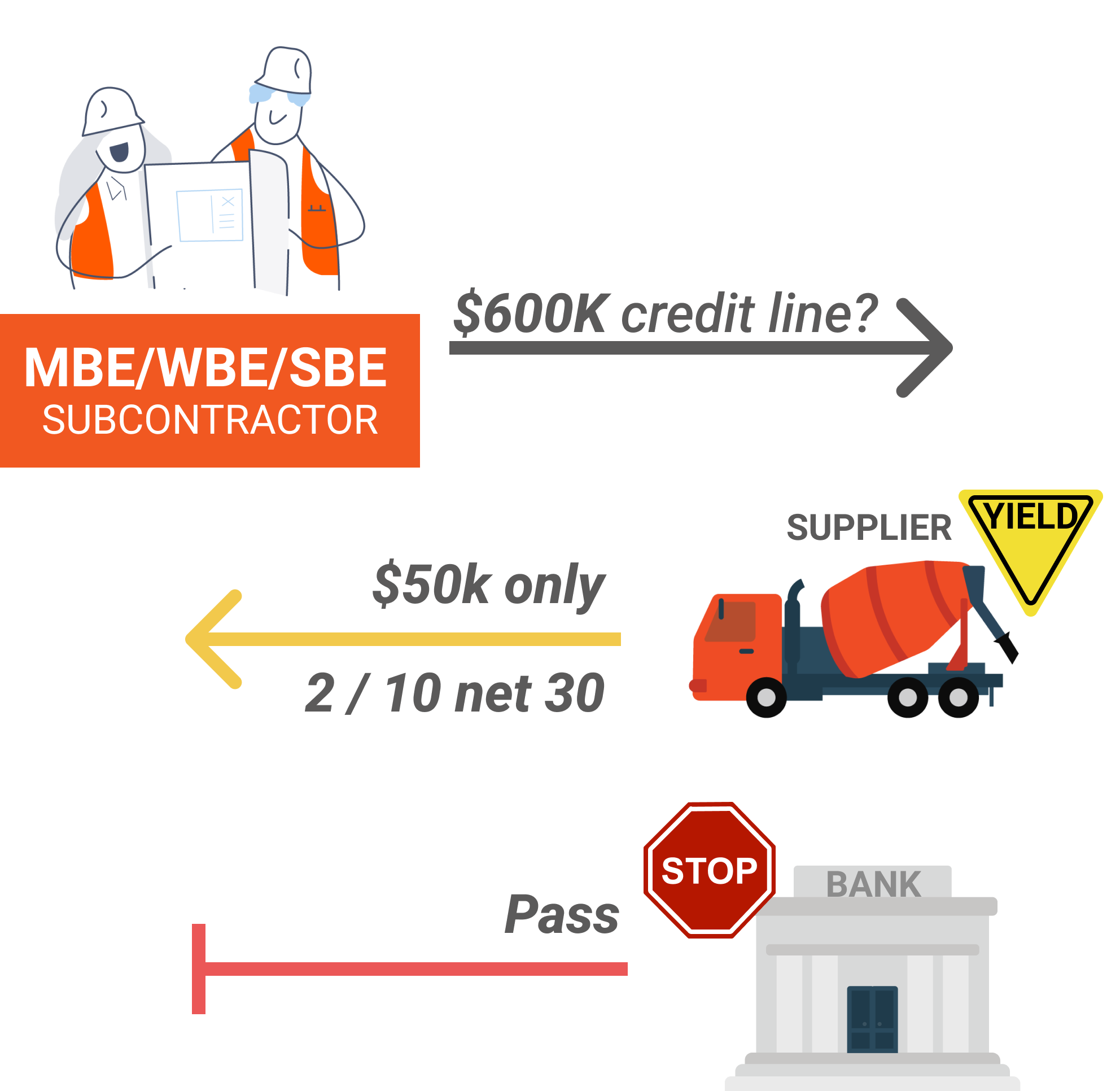

Small and Minority Businesses are Underbanked

Workforce diversity has poor access to finance. Suppliers and subcontractors that are small or from underrepresented groups and underserved communities are subject to barriers that reflect both commercial realities and human bias

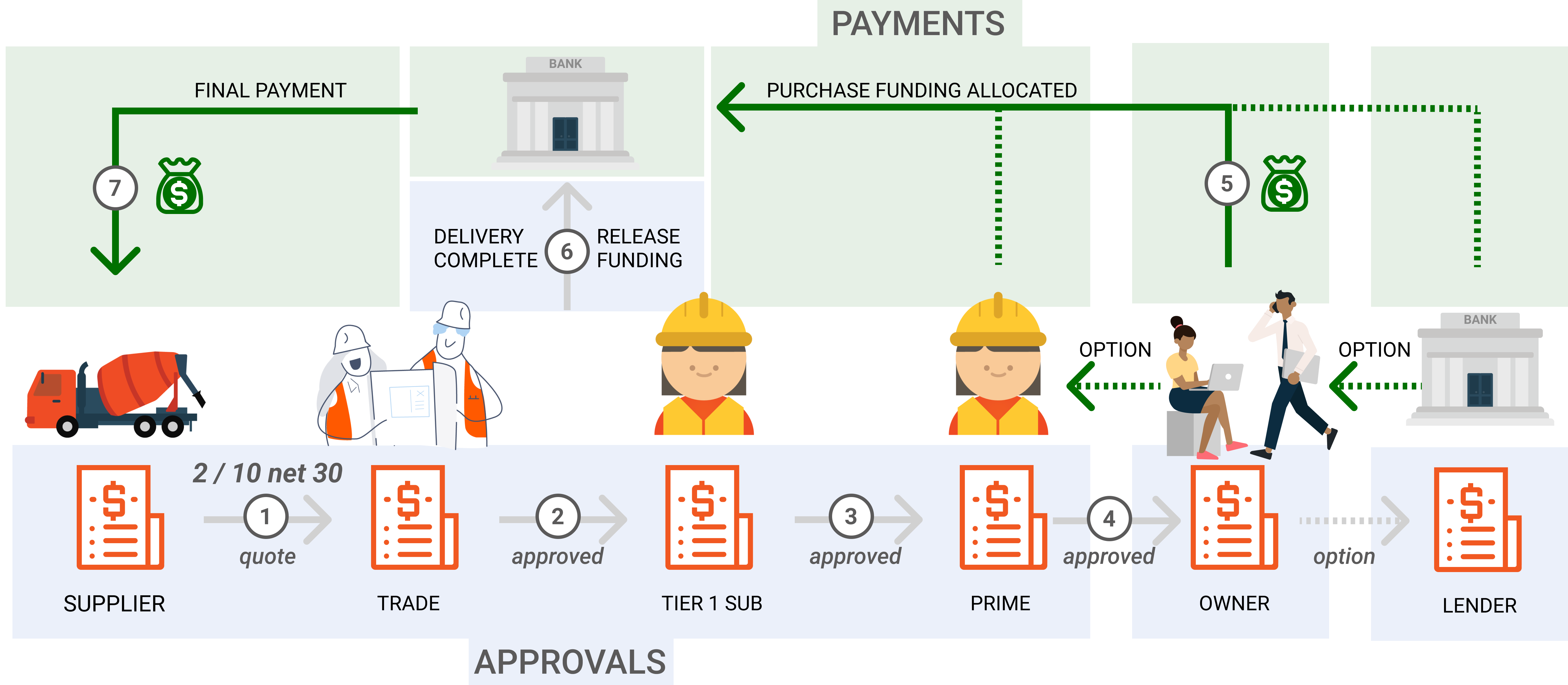

Close the Financing Gap and Reduce Risks and Attract Talent

Inject your inexpensive and completed funding. Chipi enables developers and other ecosystem members to insert their readily available funding into the construction materials purchasing process

Business Solution delivers Economic and Social Impact

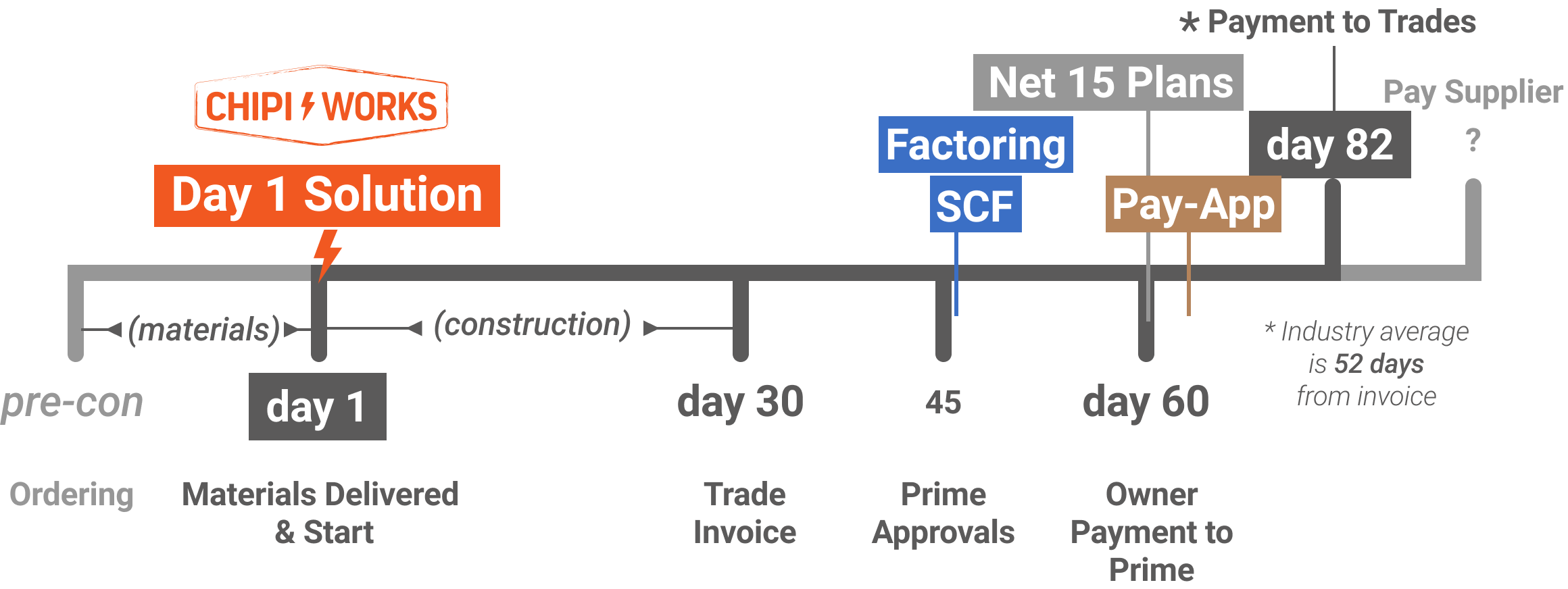

Intercepting payments for materials solves critical value chain problems, Day 1. Subcontractors and suppliers, particularly those from underserved groups, face continuous cash flow problems that are minimized when financing materials is no longer a challenge.

Use Point-to-Point Payments, which Bypasses Intermediaries and hence Avoids Delays, as a Way to Compete for the Best Subcontractors and Materials Suppliers

Remove Hurdles to Workforce Diversity

Providing Your Funding to Make Real-time Payment for Materials and Even Payroll acts a Perfect and Cost-Effective Substitute to External Finance

Eliminate Lien Workflows and Risks

Eliminate legal risks. Chipi eliminates trade credit and hence the need for lien workflows or filings as it relates to suppliers.

35% of construction firms file mechanics liens.

During COVID’s initial outbreak, lien filings grew 40% demonstrating the sensitivity and vulnerability of construction finances.

Minimize Project Risk

Money scarcity creates duress and chaos. Cash management techniques by subs that introduce project problems include risking delays in deliveries by ordering at the last moment and shifting workers to projects that will generate cash faster.

62% of subcontractors with low levels of capitalization introduce project delays.

Eliminate the cost of expensive financing embedded in your materials prices

Bank your own project and save money and lift communities.