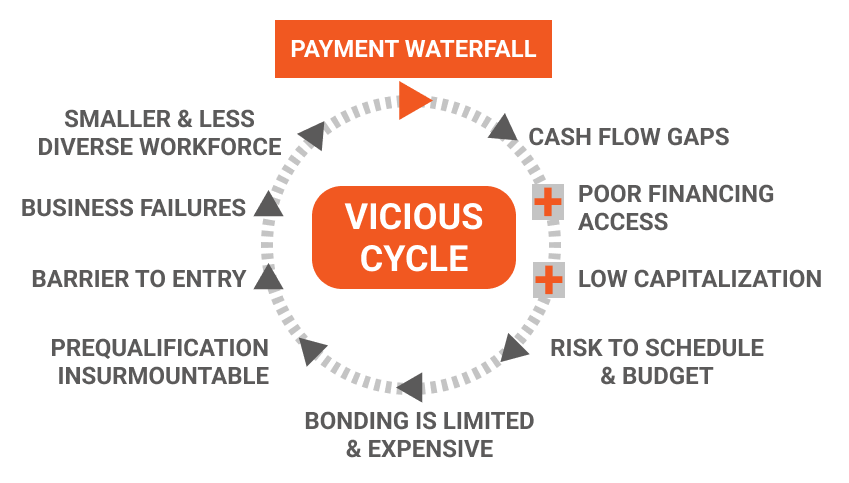

Financial Prequalification Eliminated

Risk was Managed Top-Down by Using Money as Leverage

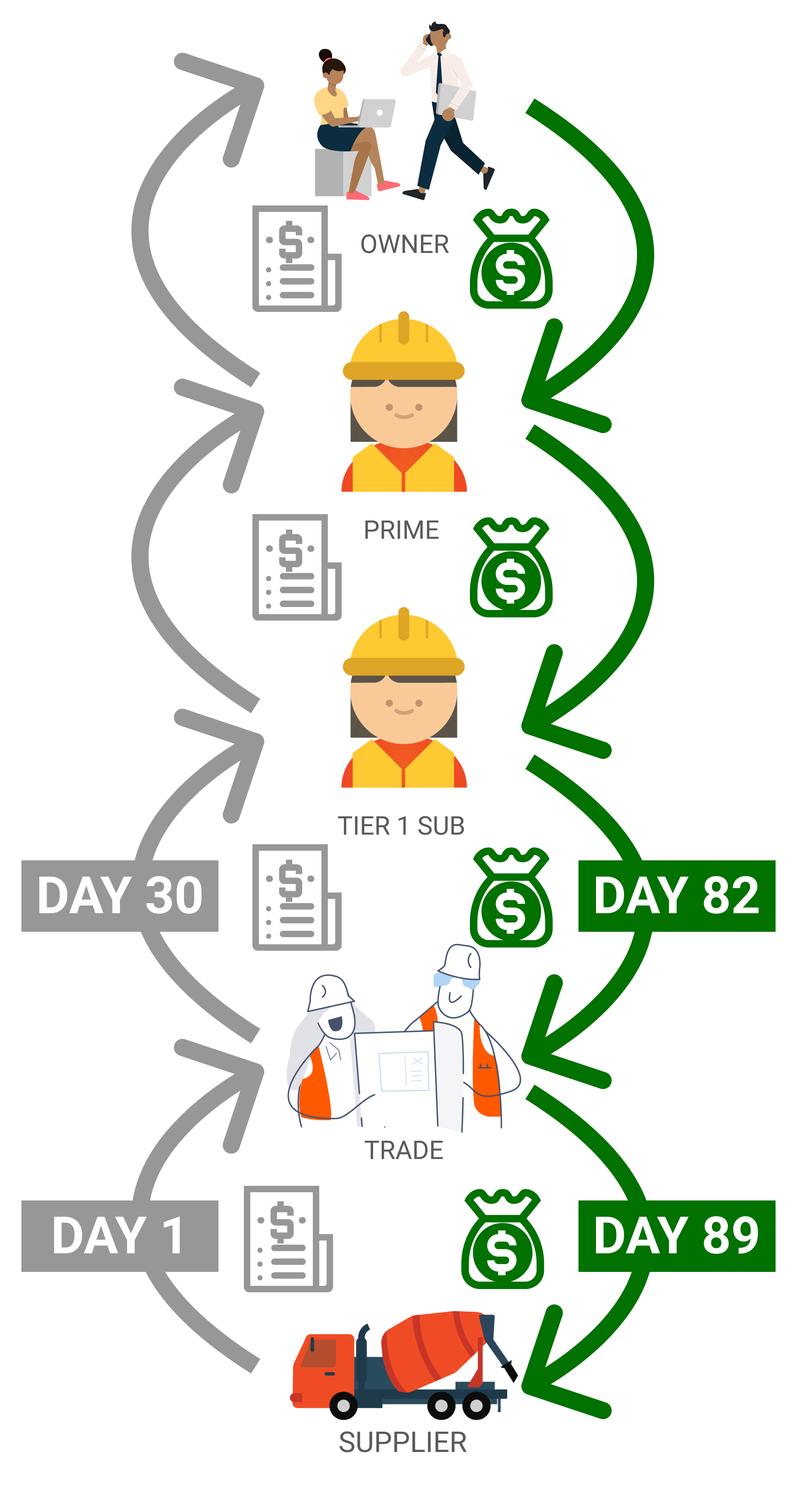

Payments Stopped at Every “Management” Level

Creating Payments Delays

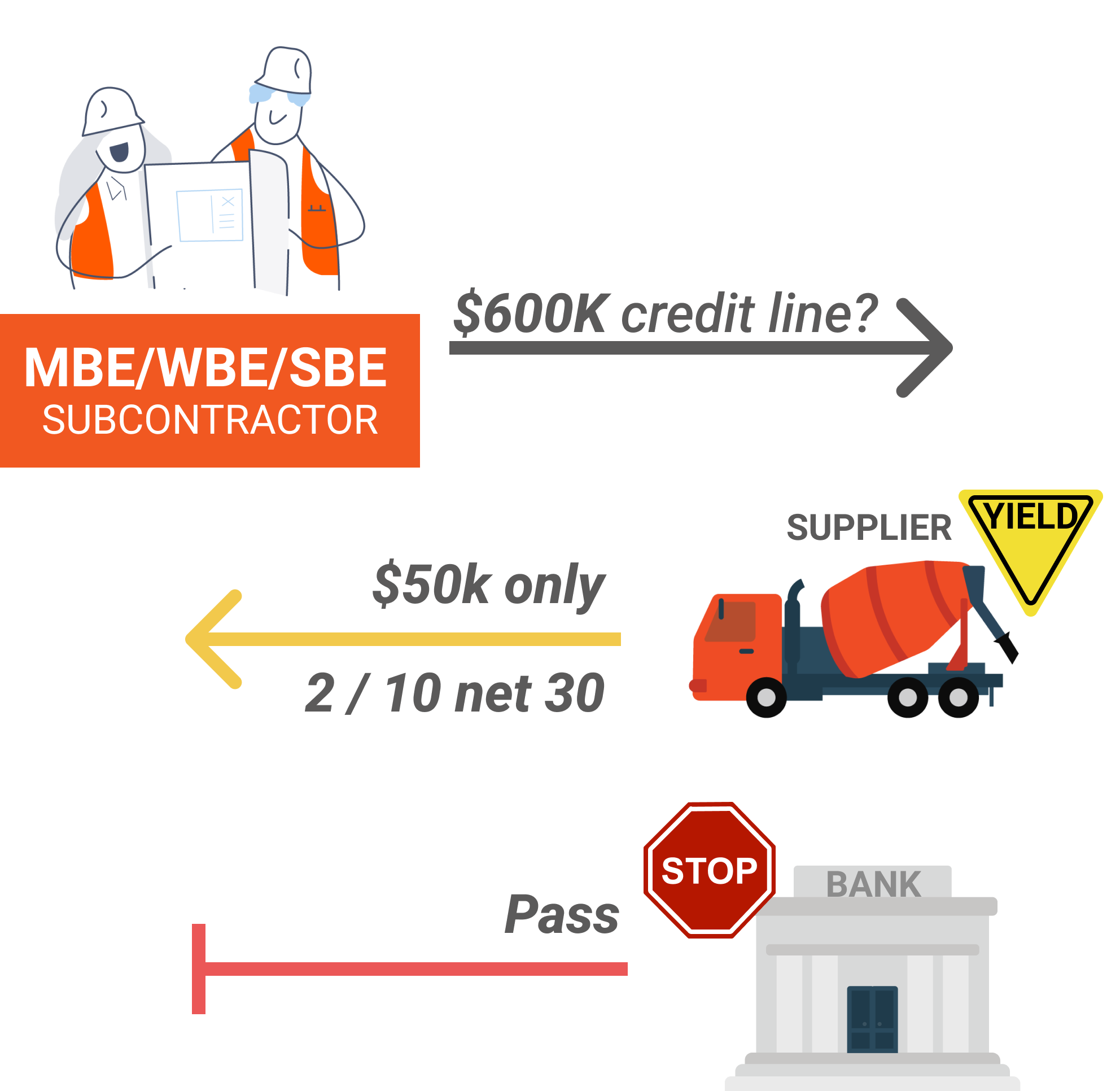

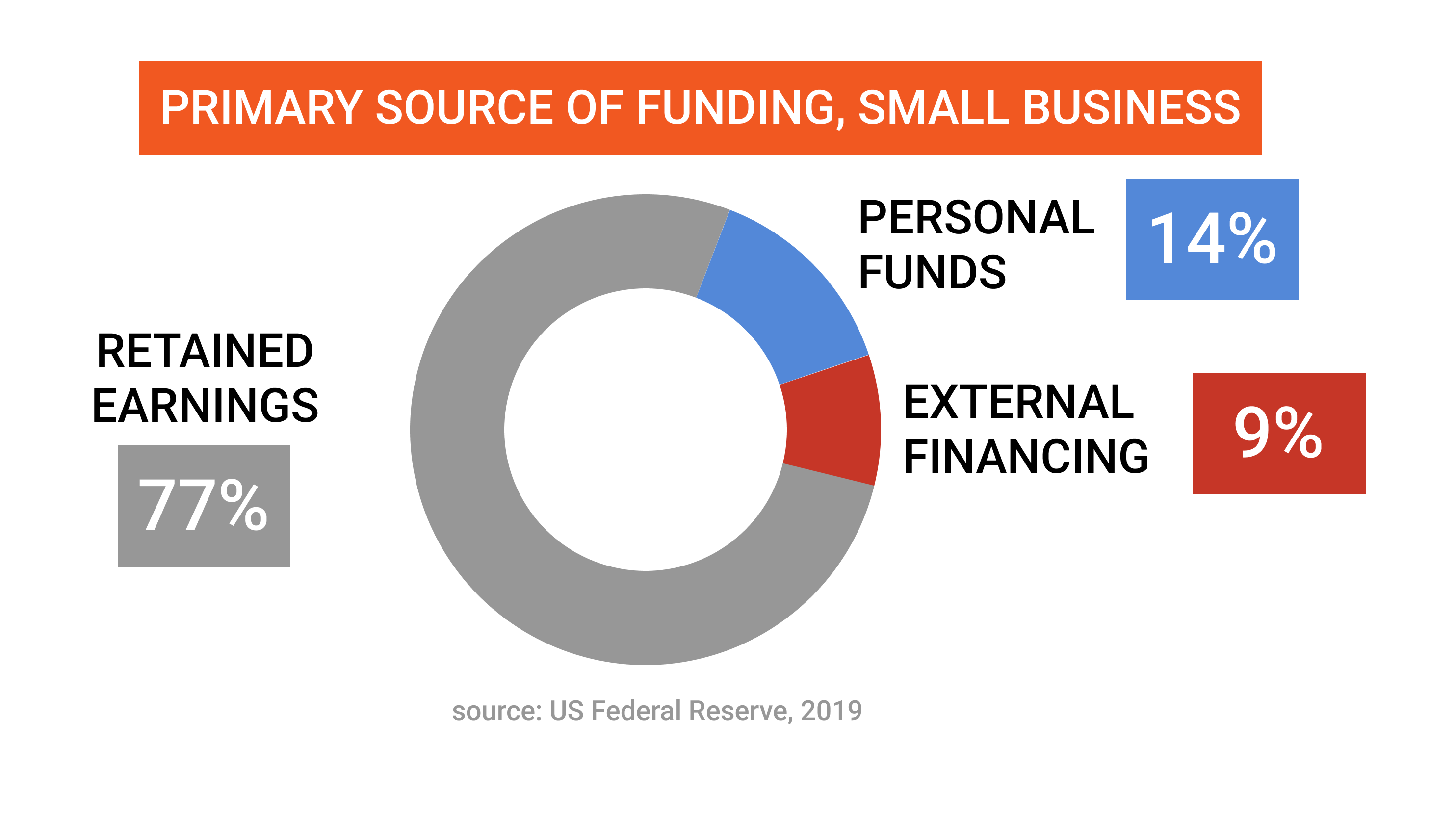

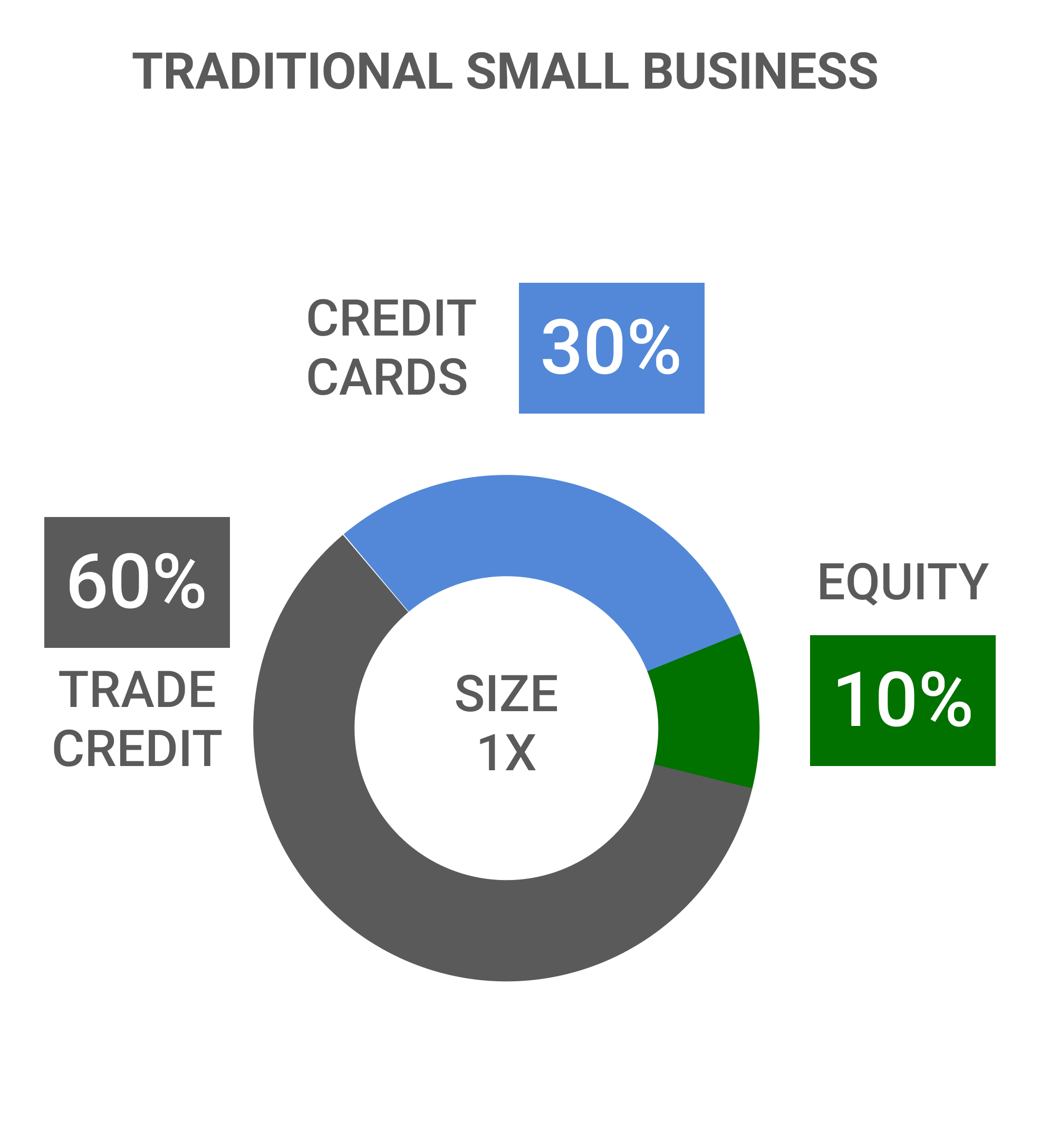

…But Small Businesses have Limited Access to Financing, especially those from Underrepresented Groups

…Resulting in a Dependency Upon Personal Savings and Retained Earnings

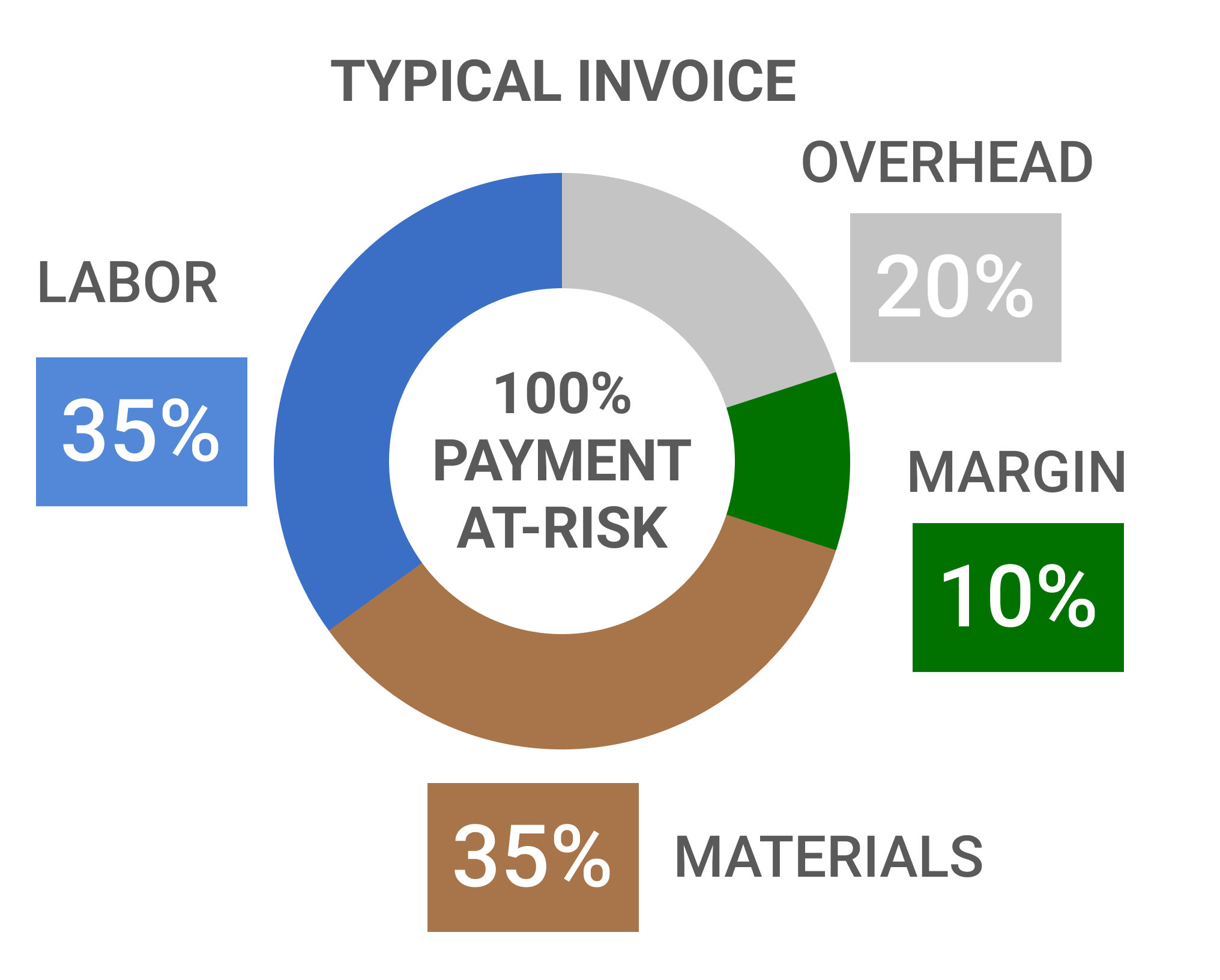

…and Profit Margins are Low which Means Small Construction Businesses Cannot Maintain Adequate Cash Reserves

14 days

Cash Buffer

for 89% of Hispanic and 94% of Black Businesses

source: JPMorgan Chase Institute

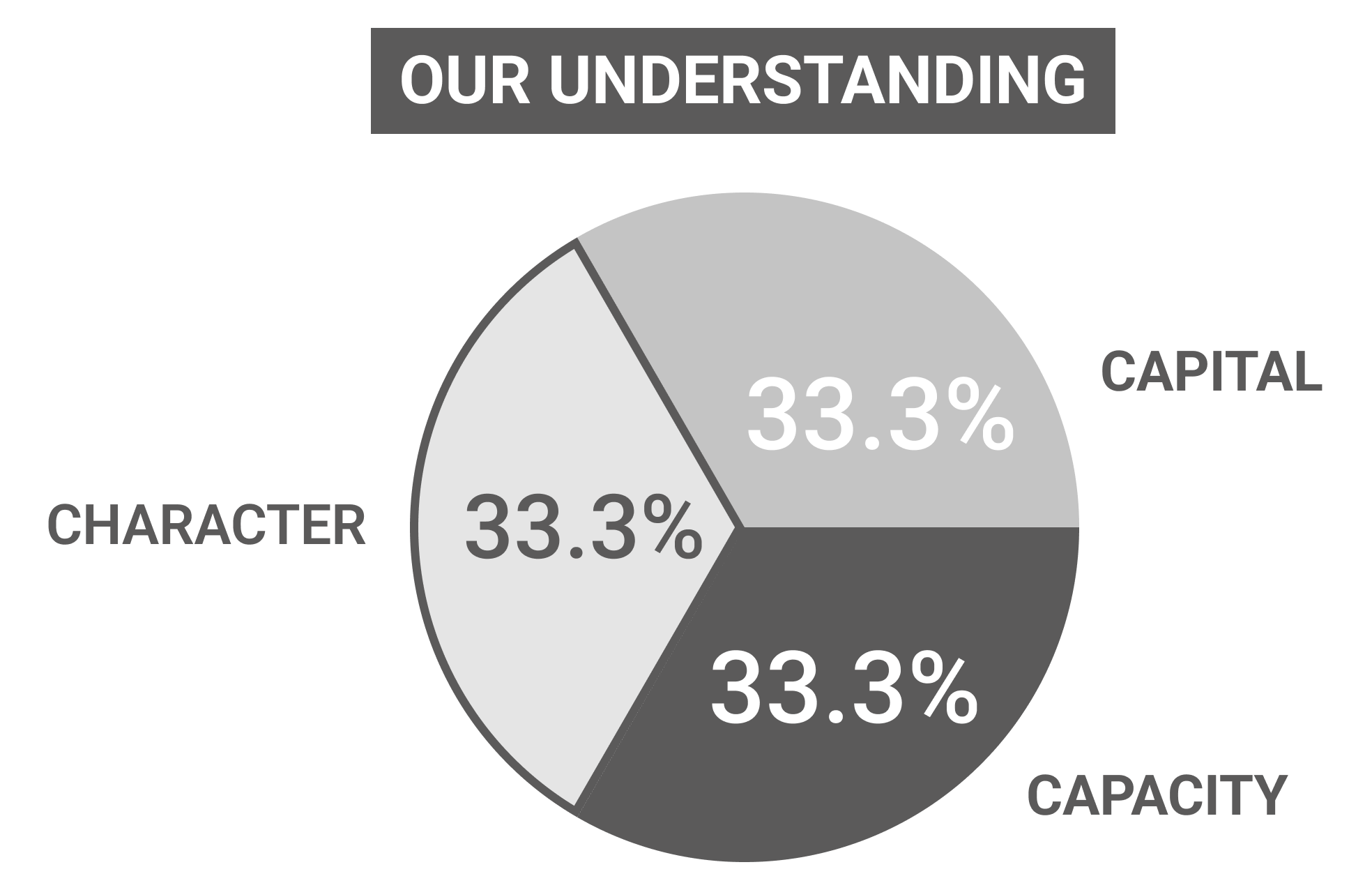

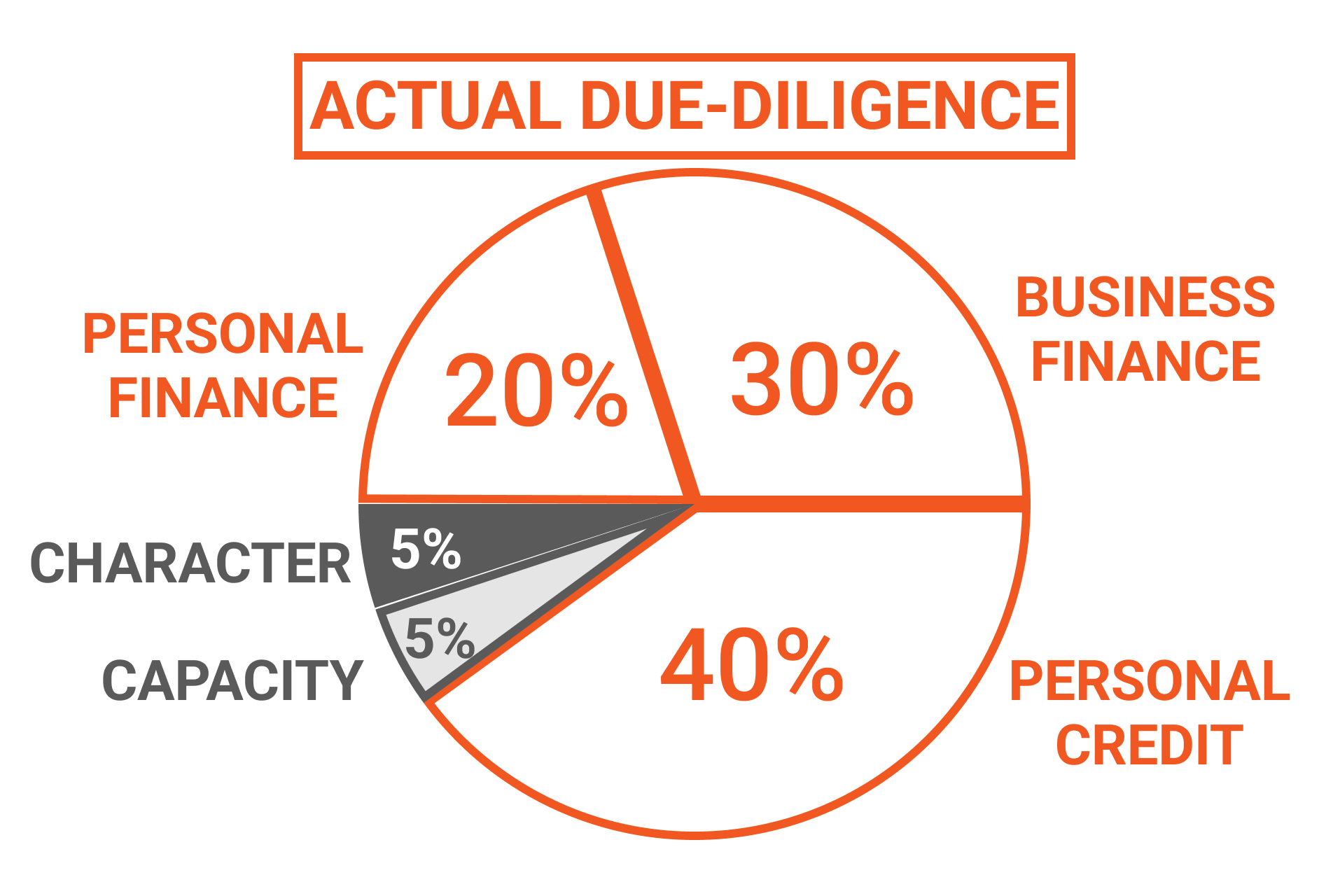

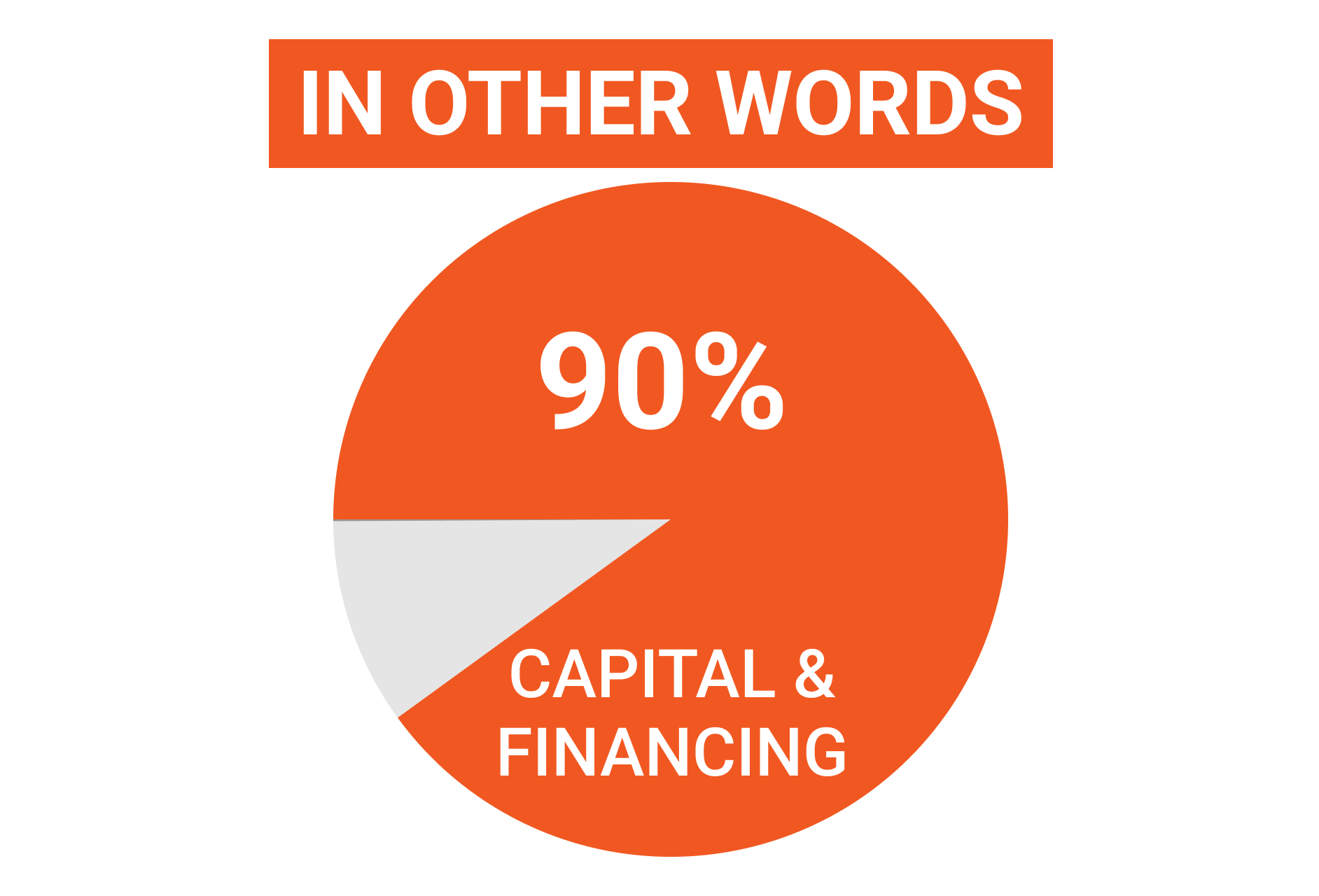

…Making Performance Bonding Challenged since it’s largely based upon Financial Due-Diligence

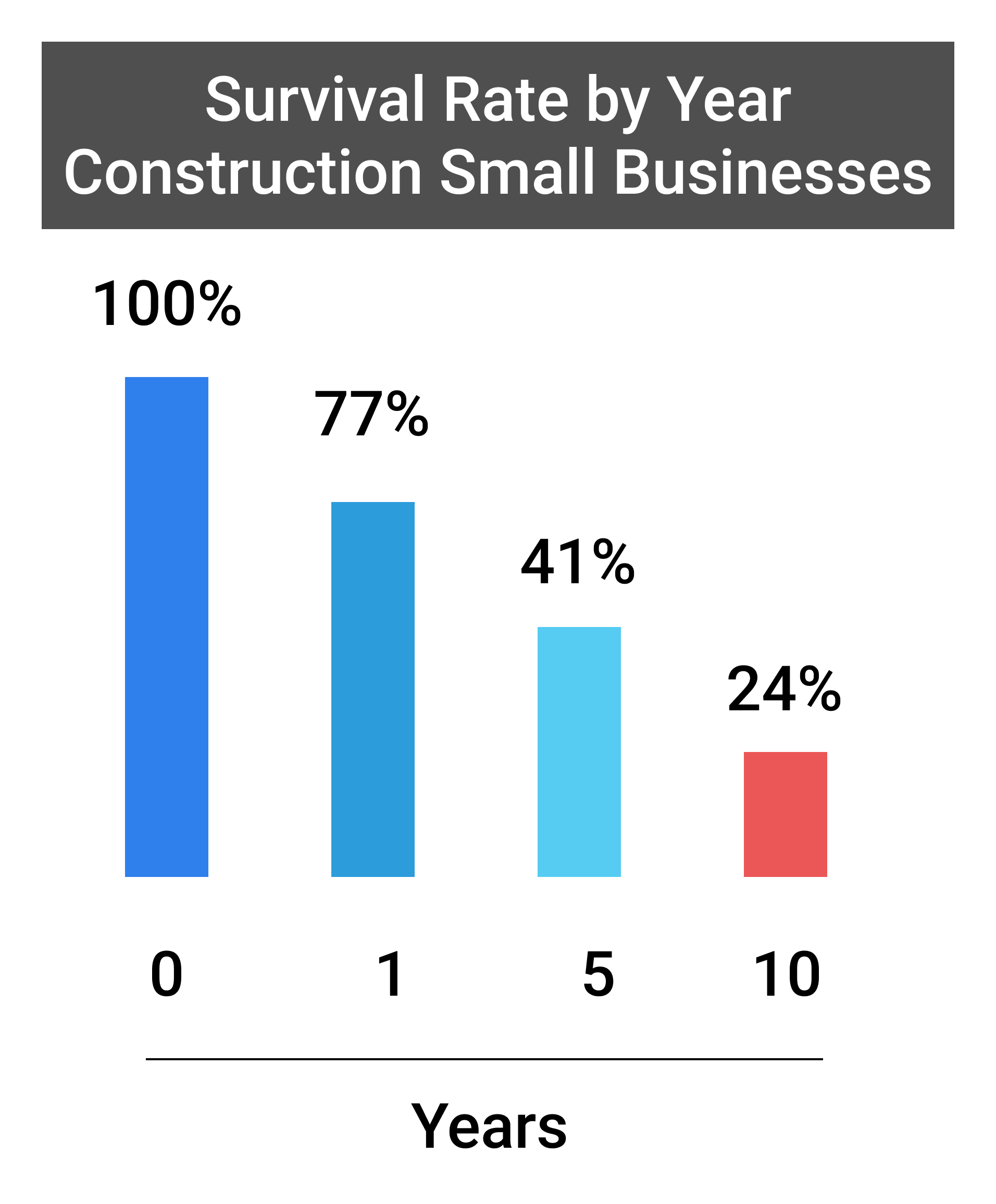

source: US Bureau of Labor Statistics

Consequently, Survival is Unlikely

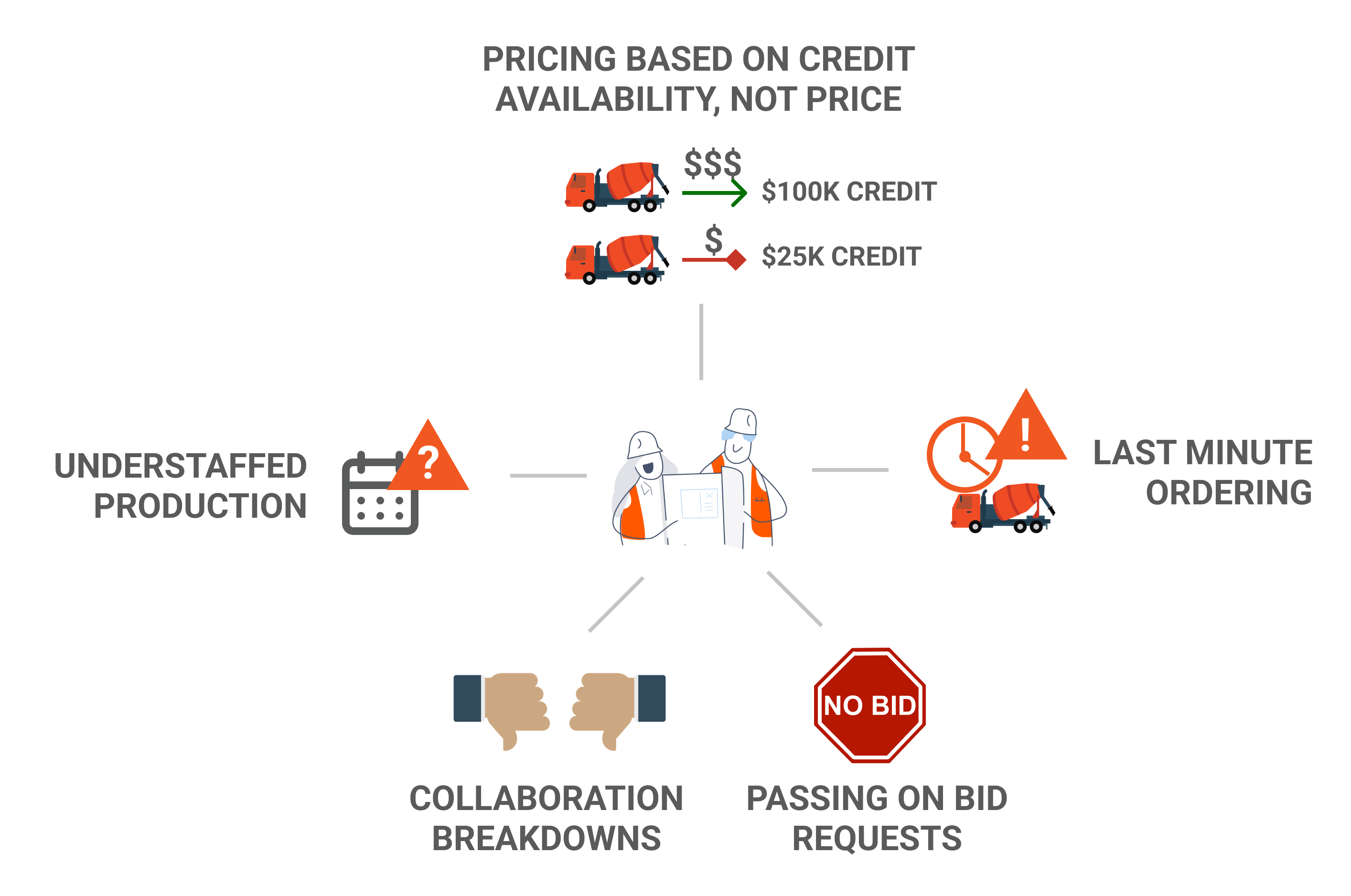

Payment Delays Create Cash Flow Gaps That Cannot Be Filled

…Which is a Problem for Everyone – Particularly the Developer

Financial Distress in Project Ecosystems Introduces Project Delays

62%

Project Delays

are Introduced by Poorly Capitalized Subcontractors (Prequalified)

Financial Prequalification Standards are Unrealistic and Complicated for Under-Resourced Small and Minority Businesses

Financial Prequalification is a Barrier to Entry

“Financial Inclusion” is the name of this Challenge

The Consensus is that Financial inclusion is a Key Enabler to Boosting Prosperity

Financial Inclusion will Attract and Grow a New Workforce Needed to Fill the Ongoing Shortage

650,000

2022 Workforce Shortage

source: Association of Builders and Contractors

Waterfall Payments Create the Very Problems Developers and GC’s are Trying to Avoid

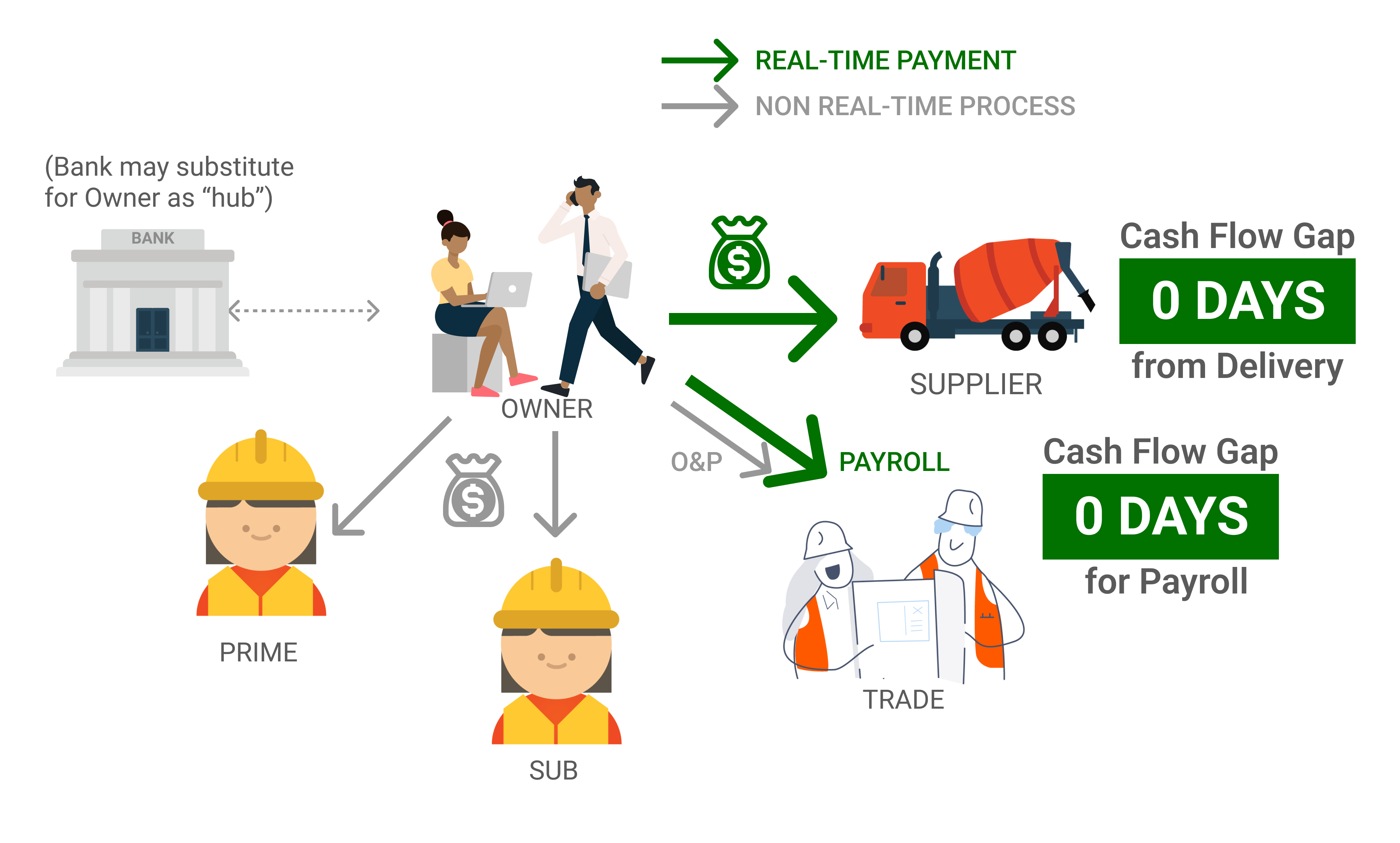

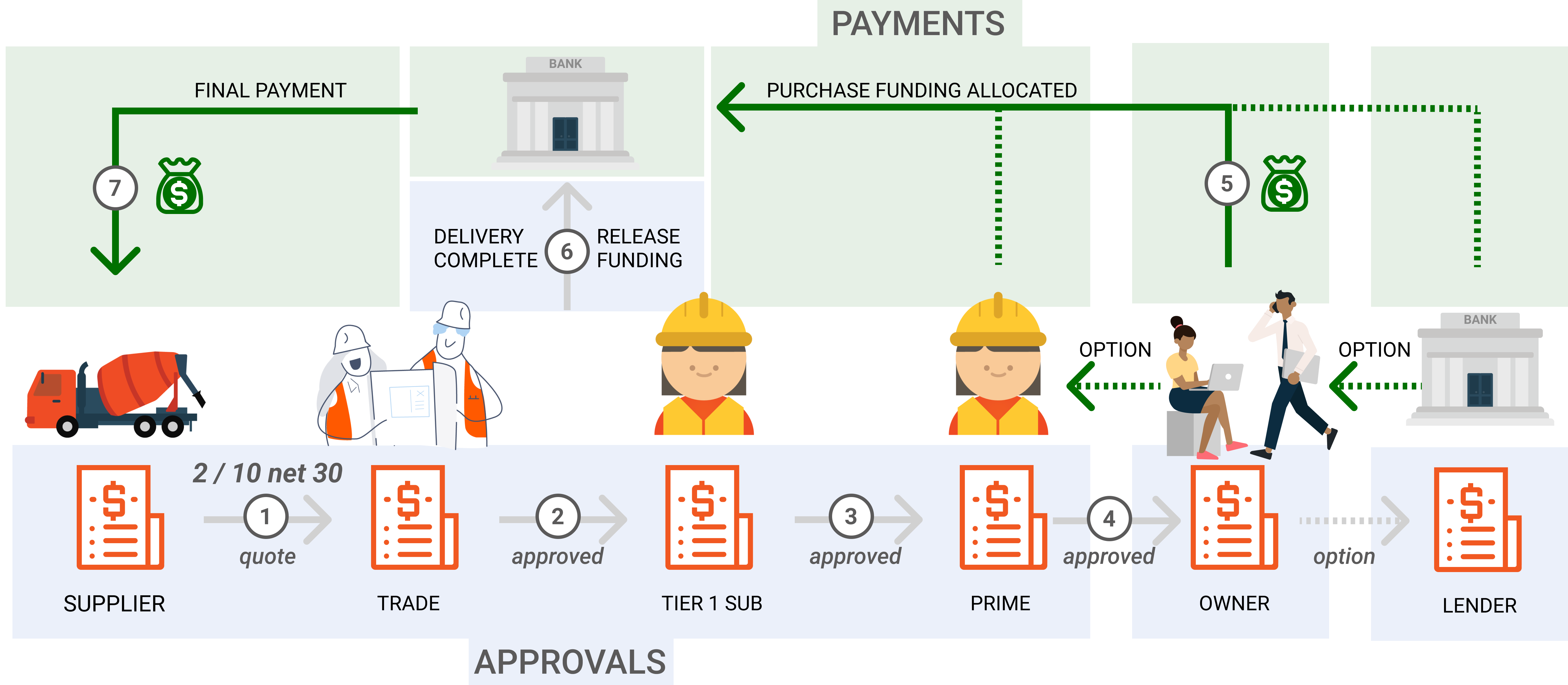

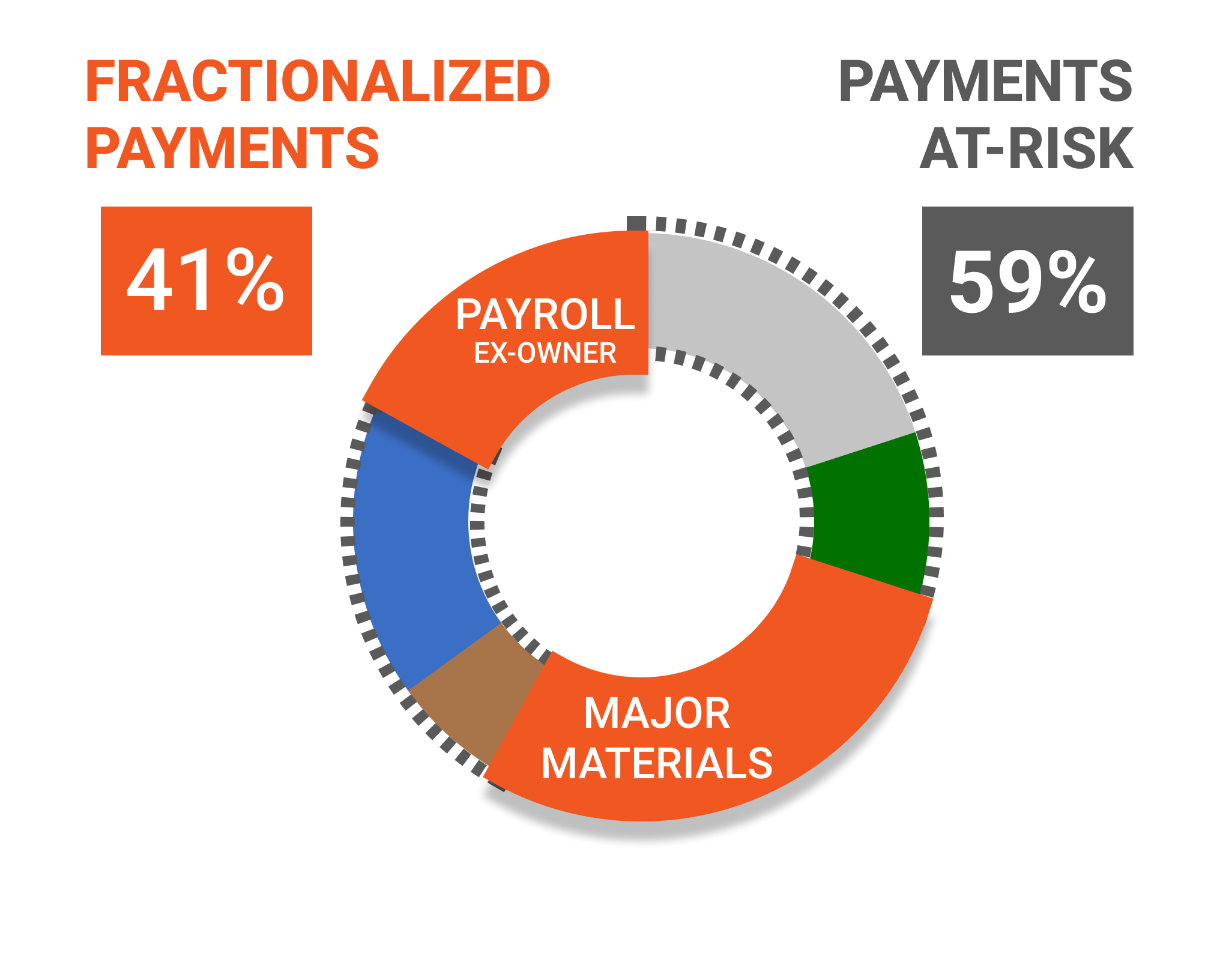

Funders Make Fractionalized Payments direct to the final destination

“Direct-to-Final” Payments Maintains Existing Approval Processes with Programmatic Release

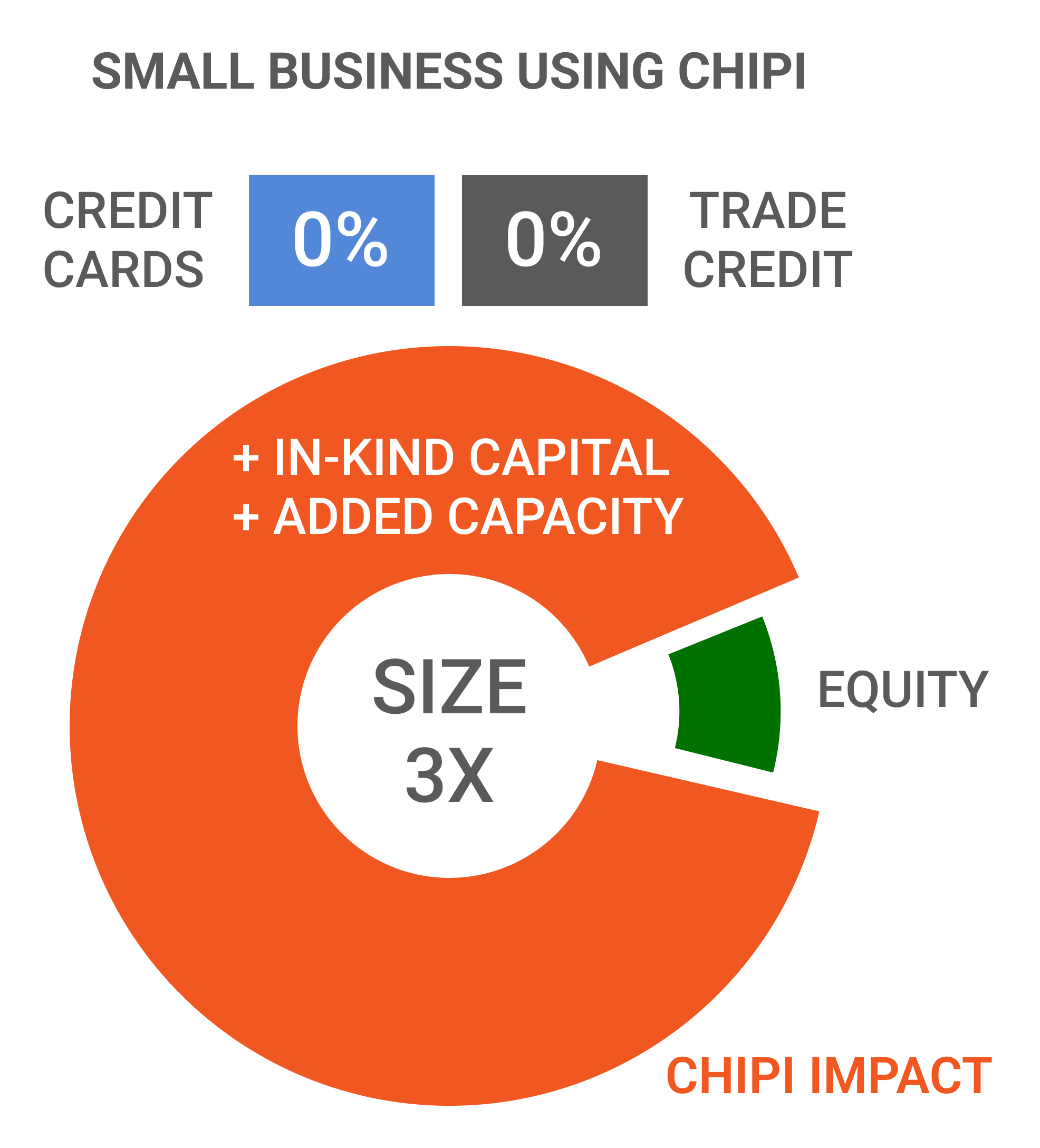

Circumvents Financial Challenges Faced by Small and Minority Business with “In-Kind” Capital

Circumvents Financial Challenges Faced by Small and Minority Business with “In-Kind” Capital

Hub & Spoke’s Fractionalized Payments Maintains Enough Invoice Value-at-Risk to Align Financial Incentives

Use Hub & Spoke Payments as a Way to Compete for the Best Subcontractors and Materials Suppliers